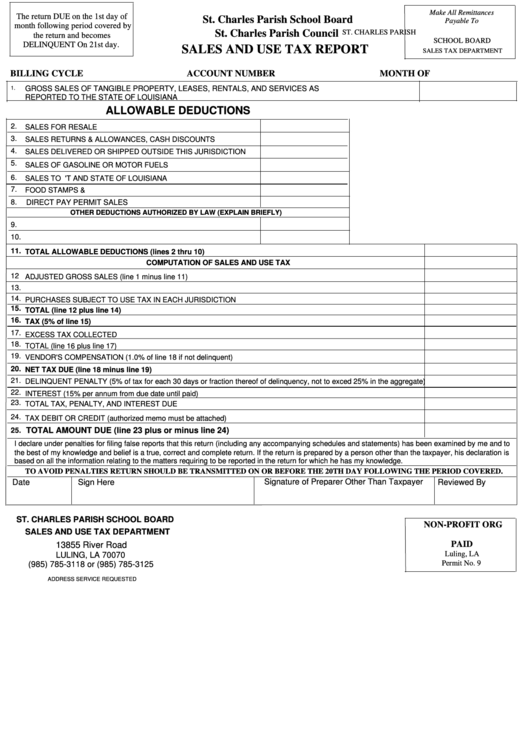

Sales And Use Tax Report - St. Charles Parish

ADVERTISEMENT

Make All Remittances

The return DUE on the 1st day of

St. Charles Parish School Board

Payable To

month following period covered by

St. Charles Parish Council

ST. CHARLES PARISH

the return and becomes

SCHOOL BOARD

DELINQUENT On 21st day.

SALES AND USE TAX REPORT

SALES TAX DEPARTMENT

BILLING CYCLE

ACCOUNT NUMBER

MONTH OF

1.

GROSS SALES OF TANGIBLE PROPERTY, LEASES, RENTALS, AND SERVICES AS

REPORTED TO THE STATE OF LOUISIANA

ALLOWABLE DEDUCTIONS

2.

SALES FOR RESALE

3.

SALES RETURNS & ALLOWANCES, CASH DISCOUNTS

4.

SALES DELIVERED OR SHIPPED OUTSIDE THIS JURISDICTION

5.

SALES OF GASOLINE OR MOTOR FUELS

6.

SALES TO U.S. GOV'T AND STATE OF LOUISIANA

7.

FOOD STAMPS & W.I.C. SALES

8.

DIRECT PAY PERMIT SALES

OTHER DEDUCTIONS AUTHORIZED BY LAW (EXPLAIN BRIEFLY)

9.

10.

11.

TOTAL ALLOWABLE DEDUCTIONS (lines 2 thru 10)

COMPUTATION OF SALES AND USE TAX

12

ADJUSTED GROSS SALES (line 1 minus line 11)

13.

14.

PURCHASES SUBJECT TO USE TAX IN EACH JURISDICTION

15.

TOTAL (line 12 plus line 14)

16.

TAX (5% of line 15)

17.

EXCESS TAX COLLECTED

18.

TOTAL (line 16 plus line 17)

19.

VENDOR'S COMPENSATION (1.0% of line 18 if not delinquent)

20.

NET TAX DUE (line 18 minus line 19)

21.

DELINQUENT PENALTY (5% of tax for each 30 days or fraction thereof of delinquency, not to exced 25% in the aggregate)

22.

INTEREST (15% per annum from due date until paid)

23.

TOTAL TAX, PENALTY, AND INTEREST DUE

24.

TAX DEBIT OR CREDIT (authorized memo must be attached)

TOTAL AMOUNT DUE (line 23 plus or minus line 24)

25.

I declare under penalties for filing false reports that this return (including any accompanying schedules and statements) has been examined by me and to

the best of my knowledge and belief is a true, correct and complete return. If the return is prepared by a person other than the taxpayer, his declaration is

based on all the information relating to the matters requiring to be reported in the return for which he has my knowledge.

TO AVOID PENALTIES RETURN SHOULD BE TRANSMITTED ON OR BEFORE THE 20TH DAY FOLLOWING THE PERIOD COVERED.

Signature of Preparer Other Than Taxpayer

Date

Sign Here

Reviewed By

ST. CHARLES PARISH SCHOOL BOARD

NON-PROFIT ORG

SALES AND USE TAX DEPARTMENT

U.S. POSTAGE

13855 River Road

PAID

Luling, LA

LULING, LA 70070

(985) 785-3118 or (985) 785-3125

Permit No. 9

ADDRESS SERVICE REQUESTED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1