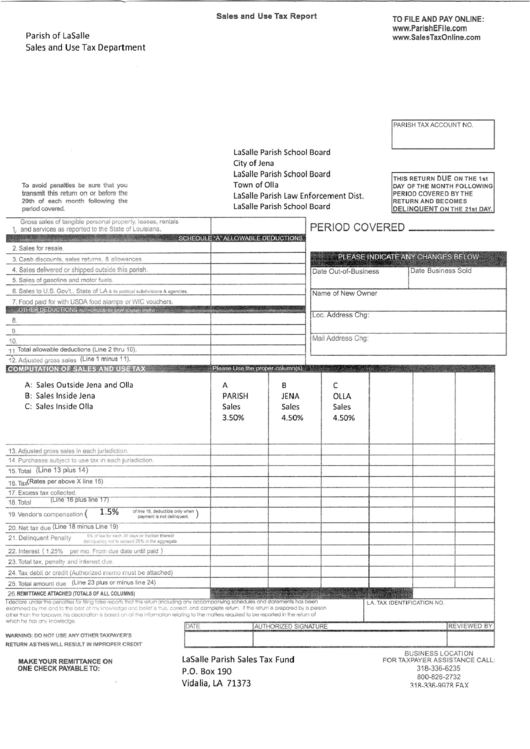

Sales And Use Tax Report - Parish Of Lasalle

ADVERTISEMENT

Parish of LaSalle

Sales and Use Tax Department

To avoid penalties be sure that you

transmit this retum on or befiore the

20th of each month following the

period covered.

Sales and Use Tax Report

LaSalle Parish

City of Jena

LaSalle Parish

Town of Olla

LaSalle Parish

LaSalle Parish

School Board

School Board

Law Enforcement Dist.

School Board

TO FILE AND PAY ONLINE:

T A X A C C O U N T N O .

T H I S R E T U R N D U E O N T H E 1 s t

D A Y O F T H E M O N T H F O L L

P E R I O D C O V E R E D B Y T H E

R E T U R N A N D B E C O M E S

Gross sales of tangible personal property, ieases, rentals

1" and services as reported to the State of Louisiana.

2. Sales for resale

3. Cash discounts, sales returns, & allowances.

4. Sales delivered or

outside this

5 . S a l e s o f

and motor fuels

6. Sales to U.S. Gov'i.. State of LA a its

subdlvisions &

7. Food oaid for with USDA food

or WIC vouchers.

L

1 1 . Total allowable deductions (Line 2 thru 1 0)

1 2 . A d j u s t e d g r o s s s a l e s

S a l e s O u t s i d e J e n a a n d O l l a

S a l e s I n s i d e J e n a

S a l e s I n s i d e O l l a

s a l e s ; n e a c h

1 4 . P u r c h a s e s s u b j e c t t o u s e t a x i n e a c h j u r i s d i c t i o n

1 5. Total

1 6. Tax(Rates per above X line 1 5)

17. Excess tax collected

18. Total

19. Vendor's compensation (

o f l i n e 1 8 , d e d u c t i b l e o n l y w h e n \

payment is not delinquent.

,,

2 0 . N e t t a x 6 u " ( L i n e 1 8 m i n u s L i n e

' 1 9 )

2 1 . D e l i n q u e n t P e n a i t y

5% cf tax for each 30 days or fra.lion thereof

o e : i n q u e n c v n c t i c e x c e e d 2 5 % r n l h e

wh ch he hos Jn\, Incwledge

PERIOD COVERED

1 0

A :

B :

C :

2 2 . I n t e r e s t ( 1 . 2 5 % p e r m c . F r o m d u e d a t e u r r t i l p a i d )

23. Total tax, penalty and interest due

24. Tax debit or credit (Authorized nremo cnusl be attached)

2 5 . T o t a l a m o u n t d u e ( L i n e 2 3 p l u s o r m i n u s l i n e 2 4 )

26, REMITTANCE ATTACHED (TOTALS OF ALL COLUMNS)

I dec ole under The

exomined tly me cnd to lhe besi of my knoviiedge onc be ief ls iiue, coileci. oncj complete relurn. if lhe return is orepoied by o person

other lhon the loxpoyet his declofoion is bosed on oll ihe nformolion reloting lo the molters requifed lo be reporled in ihe lelurn of

WARNING: DO NOT USE ANY OTHERTAXPAYER'S

RETURN ASTHISWILL RESULT IN IMPROPER CREDIT

MAKEYOUR REMITTANCE ON

ONE CHECK PAYABLETO:

B U S I N E S S L O C A T I O N

FOR TAXPAYER ASSISTANCE CALL

3 1 B-336-6235

8A0-826-2732

LaSalle Parish Sales Tax Fund

P.O. Box 190

Vidalia, LA 7L373

Mail Address Chg:

A

PARISH

Sales

350%

B

J E N A

Sales

4.50%

L A . T A X I D E N T I F I C A T I O N N O .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1