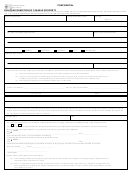

P r o p e r t y T a x

R a i l r o a d R e n d i t i o n o f T a x a b l e P r o p e r t y

Form 50-156

Inventory Sheet

_____________________________________________________________

Name of Railroad:

_____________________________________________

____________________________________________

Name of taxing unit

Code

Item (1) Property (See Sheet “A”)

_____________________

Total Market Value in Unit (Optional)*

Item (2) Property

Railroad Corridor

Includes right-of-way

Market Value Estimate

listed on Sheet “B”

(Required by Law)

______________________

______________________

______________________

Main line

Miles @ $

Per mile $

_____________________

______________________

______________________

Branch line

Miles @ $

Per mile $

______________________

______________________

______________________

Side track

Miles @ $

Per mile $

______________________

Total corridor value $

Signals and Communications

_______________________

______________________

______________________

Signals

Miles @ $

Per mile $

______________________

______________________

______________________

Signals

Miles @ $

Per mile $

__________________

______________________

______________________

Communication

Miles @ $

Per mile $

______________________

Total Signals and Communications $

Buildings:

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

______________________

Total Buildings $

______________________

Grand Total Market Value Item (2) in Unit $

Item (3) Property: (See Sheet “C”)

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

______________________

Total Estimated Market Value Item (3) in Unit (Optional)* $

______________________

Grand Total Market Value Estimate in Taxing Unit (Optional)* $

*NOTE: Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the

rendered value is to be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal review

board. (Section 25.19, Tax Code)

For more information, visit our website:

Page 4 • 50-156 • 01-12/6

1

1 2

2 3

3 4

4 5

5 6

6 7

7