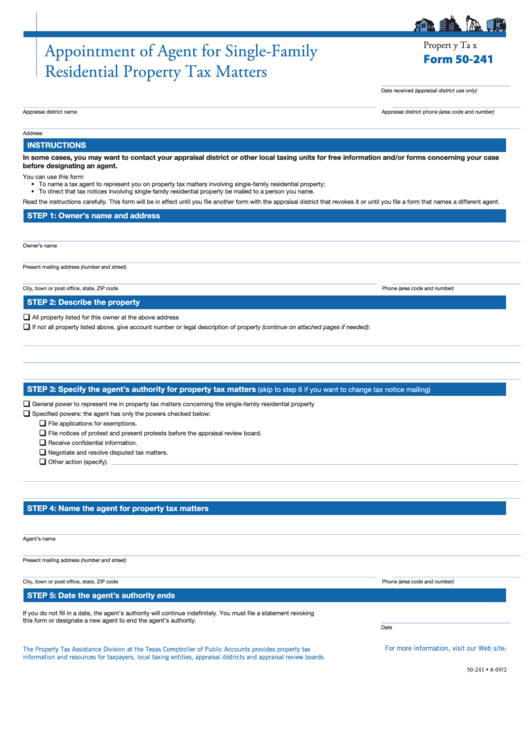

P r o p e r t y T a x

Appointment of Agent for Single-Family

Form 50-241

Residential Property Tax Matters

________________________________________________

Date received (appraisal district use only)

____________________________________________________________________________________________________________________________________

________________________________________________

Appraisal district name

Appraisal district phone (area code and number)

__________________________________________________________________________________________________________________________________________________________________________________________

Address

INSTRUCTIONS

In some cases, you may want to contact your appraisal district or other local taxing units for free information and/or forms concerning your case

before designating an agent.

You can use this form:

• To name a tax agent to represent you on property tax matters involving single-family residential property;

• To direct that tax notices involving single-family residential property be mailed to a person you name.

Read the instructions carefully. This form will be in effect until you file another form with the appraisal district that revokes it or until you file a form that names a different agent.

STEP 1: Owner’s name and address

__________________________________________________________________________________________________________________________________________________________________________________________

Owner’s name

__________________________________________________________________________________________________________________________________________________________________________________________

Present mailing address (number and street)

____________________________________________________________________________________________________________________________________

________________________________________________

City, town or post office, state, ZIP code

Phone (area code and number)

STEP 2: Describe the property

All property listed for this owner at the above address

If not all property listed above, give account number or legal description of property (continue on attached pages if needed):

__________________________________________________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________________________________________________

STEP 3: Specify the agent’s authority for property tax matters

(skip to step 6 if you want to change tax notice mailing)

General power to represent me in property tax matters concerning the single-family residential property

Specified powers: the agent has only the powers checked below:

File applications for exemptions.

File notices of protest and present protests before the appraisal review board.

Receive confidential information.

Negotiate and resolve disputed tax matters.

Other action (specify).

________________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________________________________________________

STEP 4: Name the agent for property tax matters

__________________________________________________________________________________________________________________________________________________________________________________________

Agent’s name

__________________________________________________________________________________________________________________________________________________________________________________________

Present mailing address (number and street)

____________________________________________________________________________________________________________________________________

________________________________________________

City, town or post office, state, ZIP code

Phone (area code and number)

STEP 5: Date the agent’s authority ends

If you do not fill in a date, the agent’s authority will continue indefinitely. You must file a statement revoking

this form or designate a new agent to end the agent’s authority.

________________________________________________

Date

For more information, visit our Web site:

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-241 • 8-09/2

1

1 2

2