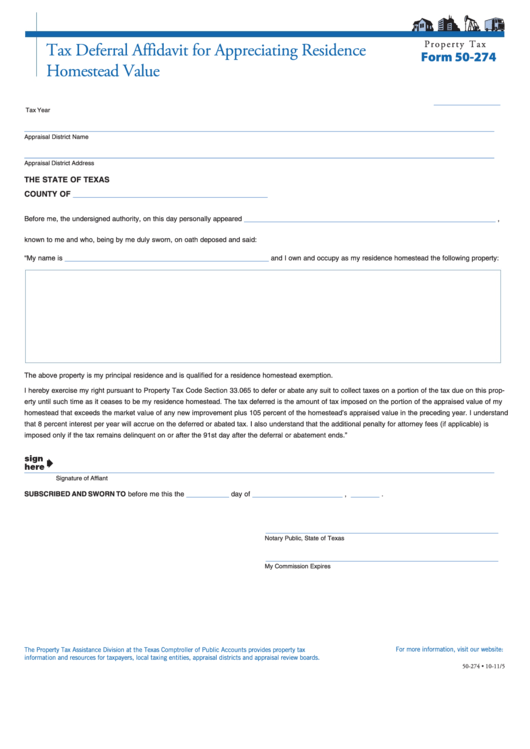

P r o p e r t y T a x

Tax Deferral Affidavit for Appreciating Residence

Form 50-274

Homestead Value

______________

Tax Year

___________________________________________________________________________________________________

Appraisal District Name

___________________________________________________________________________________________________

Appraisal District Address

THE STATE OF TEXAS

_________________________________________

COUNTY OF

_____________________________________________________

Before me, the undersigned authority, on this day personally appeared

,

known to me and who, being by me duly sworn, on oath deposed and said:

___________________________________________

“My name is

and I own and occupy as my residence homestead the following property:

The above property is my principal residence and is qualified for a residence homestead exemption.

I hereby exercise my right pursuant to Property Tax Code Section 33.065 to defer or abate any suit to collect taxes on a portion of the tax due on this prop-

erty until such time as it ceases to be my residence homestead. The tax deferred is the amount of tax imposed on the portion of the appraised value of my

homestead that exceeds the market value of any new improvement plus 105 percent of the homestead’s appraised value in the preceding year. I understand

that 8 percent interest per year will accrue on the deferred or abated tax. I also understand that the additional penalty for attorney fees (if applicable) is

imposed only if the tax remains delinquent on or after the 91st day after the deferral or abatement ends.”

___________________________________________________________________________________________________

Signature of Affiant

_________

___________________

______

SUBSCRIBED AND SWORN TO before me this the

day of

,

.

_________________________________________________

Notary Public, State of Texas

_________________________________________________

My Commission Expires

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-274 • 10-11/5

1

1