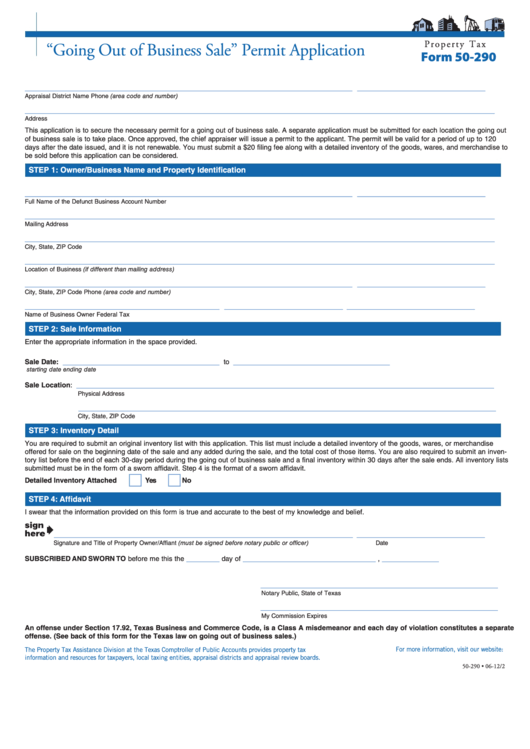

P r o p e r t y T a x

“Going Out of Business Sale” Permit Application

Form 50-290

_____________________________________________________________________

___________________________

Appraisal District Name

Phone (area code and number)

___________________________________________________________________________________________________

Address

This application is to secure the necessary permit for a going out of business sale. A separate application must be submitted for each location the going out

of business sale is to take place. Once approved, the chief appraiser will issue a permit to the applicant. The permit will be valid for a period of up to 120

days after the date issued, and it is not renewable. You must submit a $20 filing fee along with a detailed inventory of the goods, wares, and merchandise to

be sold before this application can be considered.

STEP 1: Owner/Business Name and Property Identification

_____________________________________________________________________

___________________________

Full Name of the Defunct Business

Account Number

___________________________________________________________________________________________________

Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

___________________________________________________________________________________________________

Location of Business (if different than mailing address)

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

_________________________________________

_________________________

___________________________

Name of Business Owner

Federal Tax I.D.

TX Sales Tax Permit Number

STEP 2: Sale Information

Enter the appropriate information in the space provided.

_________________________________

_________________________________

Sale Date:

to

starting date

ending date

________________________________________________________________________________________

Sale Location:

Physical Address

________________________________________________________________________________________

City, State, ZIP Code

STEP 3: Inventory Detail

You are required to submit an original inventory list with this application. This list must include a detailed inventory of the goods, wares, or merchandise

offered for sale on the beginning date of the sale and any added during the sale, and the total cost of those items. You are also required to submit an inven-

tory list before the end of each 30-day period during the going out of business sale and a final inventory within 30 days after the sale ends. All inventory lists

submitted must be in the form of a sworn affidavit. Step 4 is the format of a sworn affidavit.

Detailed Inventory Attached

Yes

No

STEP 4: Affidavit

I swear that the information provided on this form is true and accurate to the best of my knowledge and belief.

_______________________________________________________________

___________________________

Signature and Title of Property Owner/Affiant (must be signed before notary public or officer)

Date

_______

____________________________

____________

SUBSCRIBED AND SWORN TO before me this the

day of

,

__________________________________________________

Notary Public, State of Texas

__________________________________________________

My Commission Expires

An offense under Section 17.92, Texas Business and Commerce Code, is a Class A misdemeanor and each day of violation constitutes a separate

offense. (See back of this form for the Texas law on going out of business sales.)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-290 • 06-12/2

1

1 2

2