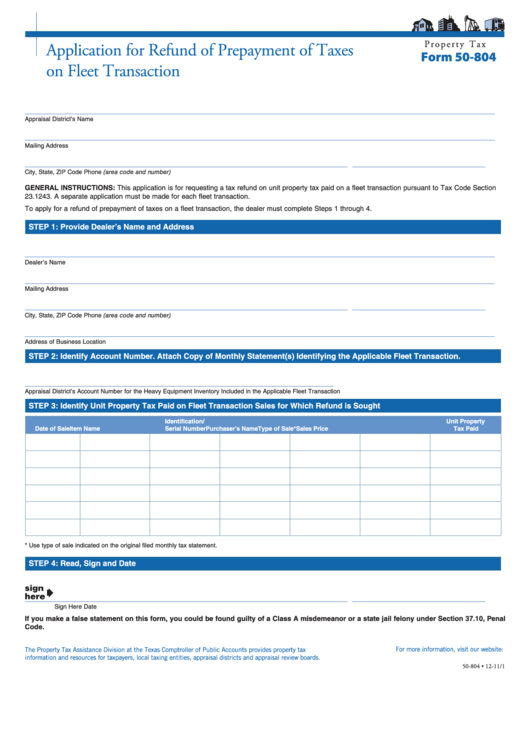

P r o p e r t y T a x

Application for Refund of Prepayment of Taxes

Form 50-804

on Fleet Transaction

___________________________________________________________________________________________________

Appraisal District’s Name

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

GENERAL INSTRUCTIONS: This application is for requesting a tax refund on unit property tax paid on a fleet transaction pursuant to Tax Code Section

23.1243. A separate application must be made for each fleet transaction.

To apply for a refund of prepayment of taxes on a fleet transaction, the dealer must complete Steps 1 through 4.

STEP 1: Provide Dealer’s Name and Address

___________________________________________________________________________________________________

Dealer’s Name

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

___________________________________________________________________________________________________

Address of Business Location

STEP 2: Identify Account Number. Attach Copy of Monthly Statement(s) Identifying the Applicable Fleet Transaction.

_________________________________________________________________

Appraisal District’s Account Number for the Heavy Equipment Inventory Included in the Applicable Fleet Transaction

STEP 3: Identify Unit Property Tax Paid on Fleet Transaction Sales for Which Refund is Sought

Identification/

Unit Property

Date of Sale

Item Name

Serial Number

Purchaser’s Name

Type of Sale*

Sales Price

Tax Paid

* Use type of sale indicated on the original filed monthly tax statement.

STEP 4: Read, Sign and Date

____________________________________________________________________

____________________________

Sign Here

Date

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal

Code.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-804 • 12-11/1

1

1