b.

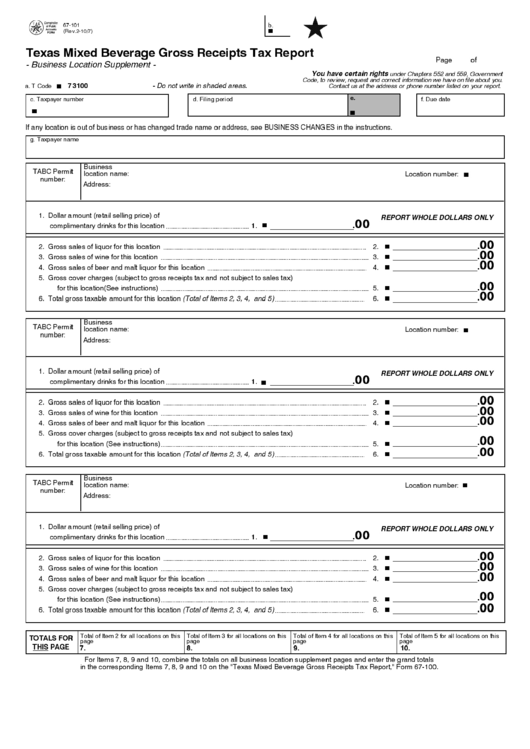

67-101

(Rev.2-10/7)

Texas Mixed Beverage Gross Receipts Tax Report

Page

of

- Business Location Supplement

You have certain rights

under Chapters 552 and 559, Government

Code, to review, request and correct information we have on file about you.

73100

- Do not write in shaded areas.

a. T Code

Contact us at the address or phone number listed on your report.

c. Taxpayer number

d. Filing period

f. Due date

e.

If any location is out of business or has changed trade name or address, see BUSINESS CHANGES in the instructions.

g. Taxpayer name

Business

TABC Permit

location name:

Location number:

number:

Address:

1. Dollar amount (retail selling price) of

REPORT WHOLE DOLLARS ONLY

complimentary drinks for this location

1.

.00

2. Gross sales of liquor for this location

2.

.00

3. Gross sales of wine for this location

3.

.00

4. Gross sales of beer and malt liquor for this location

4.

.00

5. Gross cover charges (subject to gross receipts tax and not subject to sales tax)

for this location(See instructions)

5.

.00

6. Total gross taxable amount for this location (Total of Items 2, 3, 4, and 5)

6.

.00

Business

TABC Permit

location name:

Location number:

number:

Address:

1. Dollar amount (retail selling price) of

REPORT WHOLE DOLLARS ONLY

complimentary drinks for this location

1.

.00

2. Gross sales of liquor for this location

2.

.00

3. Gross sales of wine for this location

3.

.00

4. Gross sales of beer and malt liquor for this location

4.

.00

5. Gross cover charges (subject to gross receipts tax and not subject to sales tax)

for this location (See instructions)

5.

.00

6. Total gross taxable amount for this location (Total of Items 2, 3, 4, and 5)

6.

.00

Business

TABC Permit

location name:

Location number:

number:

Address:

1. Dollar amount (retail selling price) of

REPORT WHOLE DOLLARS ONLY

complimentary drinks for this location

1.

.00

2. Gross sales of liquor for this location

2.

.00

3. Gross sales of wine for this location

3.

.00

4. Gross sales of beer and malt liquor for this location

4.

.00

5. Gross cover charges (subject to gross receipts tax and not subject to sales tax)

for this location (See instructions)

5.

.00

6. Total gross taxable amount for this location (Total of Items 2, 3, 4, and 5)

6.

.00

Total of Item 2 for all locations on this

Total of Item 3 for all locations on this

Total of Item 4 for all locations on this

Total of Item 5 for all locations on this

TOTALS FOR

page

page

page

page

THIS PAGE

7.

8.

9.

10.

For Items 7, 8, 9 and 10, combine the totals on all business location supplement pages and enter the grand totals

in the corresponding Items 7, 8, 9 and 10 on the "Texas Mixed Beverage Gross Receipts Tax Report," Form 67-100.

1

1