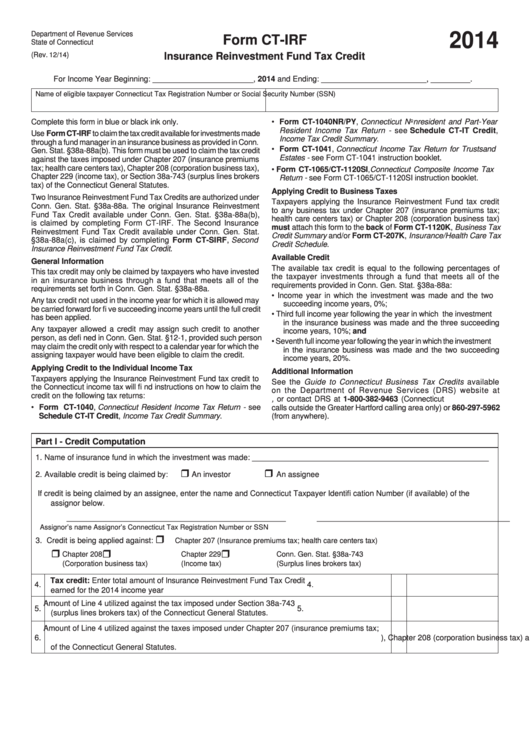

Form Ct-Irf - Insurance Reinvestment Fund Tax Credit - Connecticut Department Of Revenue - 2014

ADVERTISEMENT

Department of Revenue Services

2014

Form CT-IRF

State of Connecticut

(Rev.

)

12/14

Insurance Reinvestment Fund Tax Credit

For Income Year Beginning: _______________________ , 2014 and Ending: ________________________ , _________ .

Name of eligible taxpayer

Connecticut Tax Registration Number or Social Security Number (SSN)

Complete this form in blue or black ink only.

• Form CT-1040NR/PY, Connecticut Nonresident and Part-Year

Resident Income Tax Return - see Schedule CT-IT Credit,

Use Form CT-IRF to claim the tax credit available for investments made

Income Tax Credit Summary.

through a fund manager in an insurance business as provided in Conn.

• Form CT-1041, Connecticut Income Tax Return for Trusts and

Gen. Stat. §38a-88a(b). This form must be used to claim the tax credit

Estates - see Form CT-1041 instruction booklet.

against the taxes imposed under Chapter 207 (insurance premiums

tax; health care centers tax), Chapter 208 (corporation business tax),

• Form CT-1065/CT-1120SI, Connecticut Composite Income Tax

Chapter 229 (income tax), or Section 38a-743 (surplus lines brokers

Return - see Form CT-1065/CT-1120SI instruction booklet.

tax) of the Connecticut General Statutes.

Applying Credit to Business Taxes

Two Insurance Reinvestment Fund Tax Credits are authorized under

Taxpayers applying the Insurance Reinvestment Fund tax credit

Conn. Gen. Stat. §38a-88a. The original Insurance Reinvestment

to any business tax under Chapter 207 (insurance premiums tax;

Fund Tax Credit available under Conn. Gen. Stat. §38a-88a(b),

health care centers tax) or Chapter 208 (corporation business tax)

is claimed by completing Form CT-IRF. The Second Insurance

must attach this form to the back of Form CT-1120K, Business Tax

Reinvestment Fund Tax Credit available under Conn. Gen. Stat.

Credit Summary and/or Form CT-207K, Insurance/Health Care Tax

§38a-88a(c), is claimed by completing Form CT-SIRF, Second

Credit Schedule.

Insurance Reinvestment Fund Tax Credit.

Available Credit

General Information

The available tax credit is equal to the following percentages of

This tax credit may only be claimed by taxpayers who have invested

the taxpayer investments through a fund that meets all of the

in an insurance business through a fund that meets all of the

requirements provided in Conn. Gen. Stat. §38a-88a:

requirements set forth in Conn. Gen. Stat. §38a-88a.

•

Income year in which the investment was made and the two

Any tax credit not used in the income year for which it is allowed may

succeeding income years, 0%;

be carried forward for fi ve succeeding income years until the full credit

•

Third full income year following the year in which the investment

has been applied.

in the insurance business was made and the three succeeding

Any taxpayer allowed a credit may assign such credit to another

income years, 10%; and

person, as defi ned in Conn. Gen. Stat. §12-1, provided such person

•

Seventh full income year following the year in which the investment

may claim the credit only with respect to a calendar year for which the

in the insurance business was made and the two succeeding

assigning taxpayer would have been eligible to claim the credit.

income years, 20%.

Applying Credit to the Individual Income Tax

Additional Information

Taxpayers applying the Insurance Reinvestment Fund tax credit to

See the Guide to Connecticut Business Tax Credits available

the Connecticut income tax will fi nd instructions on how to claim the

on the Department of Revenue Services (DRS) website at

credit on the following tax returns:

, or contact DRS at 1-800-382-9463 (Connecticut

• Form CT-1040, Connecticut Resident Income Tax Return - see

calls outside the Greater Hartford calling area only) or 860-297-5962

Schedule CT-IT Credit, Income Tax Credit Summary.

(from anywhere).

Part I - Credit Computation

1.

Name of insurance fund in which the investment was made: ______________________________________________________

2.

Available credit is being claimed by:

An investor

An assignee

If credit is being claimed by an assignee, enter the name and Connecticut Taxpayer Identifi cation Number (if available) of the

assignor below.

__________________________________________________

____________________________________________

Assignor’s name

Assignor’s Connecticut Tax Registration Number or SSN

3.

Credit is being applied against:

Chapter 207 (Insurance premiums tax; health care centers tax)

Chapter 208

Chapter 229

Conn. Gen. Stat. §38a-743

(Corporation business tax)

(Income tax)

(Surplus lines brokers tax)

Tax credit: Enter total amount of Insurance Reinvestment Fund Tax Credit

4.

4.

earned for the 2014 income year

Amount of Line 4 utilized against the tax imposed under Section 38a-743

5.

5.

(surplus lines brokers tax) of the Connecticut General Statutes.

Amount of Line 4 utilized against the taxes imposed under Chapter 207 (insurance premiums tax;

6.

health care centers tax), Chapter 208 (corporation business tax) and Chapter 229 (income tax)

6.

of the Connecticut General Statutes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2