IT 2

Rev. 5/06

Employer Instructions

Form IT 2, Wage and Tax Statement, must be prepared for each employee to whom wages are paid

and from whom tax was withheld.

A. The statement must contain the following information:

1. Employee’s name, address, ZIP code and Social Security number;

2. Employer’s name, address, ZIP code, federal employer identifi cation number and Ohio with-

holding account number;

3. Total Ohio wages paid to the employee before payroll deductions;

4. Total income tax withheld from the employee’s wages;

5. Total wages paid to employee for federal tax purposes if different from Ohio wages paid;

6. The calendar year Ohio wages were paid;

7. Total school district wages paid to the employee before payroll deductions;

8. Total school district income tax withheld from the employee’s wages.

B. Distribute Wage and Tax Statement as follows:

1. Send Copy A to the Ohio Department of Taxation, P.O. Box 2476, Columbus, OH 43216-2476,

together with form IT 3 on or before the last day of February of the succeeding calendar year;

2. Give Copies B, C and D to the employee on or before Jan. 31st (if the employee is in your em-

ploy at the last of the year) or no later than 30 days after termination of employment before the

close of the calendar year;

3. Copy E is for the employer’s records; retain this copy.

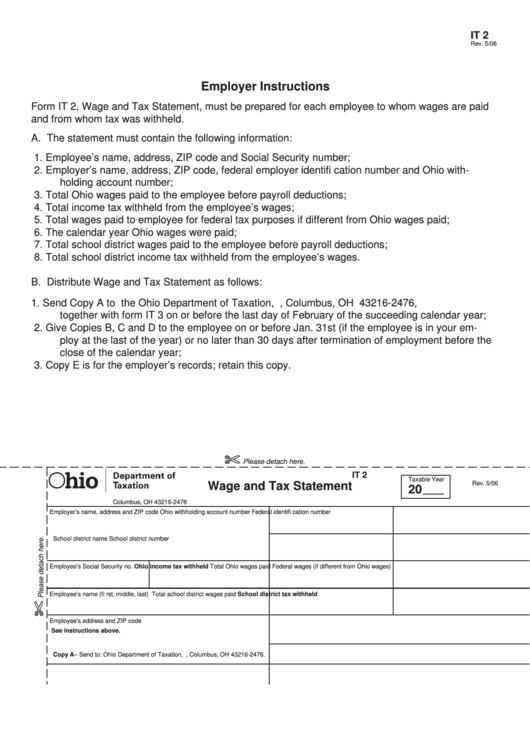

Reset Form

Please detach here.

IT 2

Taxable Year

Rev. 5/06

Wage and Tax Statement

20

P.O. Box 2476

Columbus, OH 43216-2476

Employer’s name, address and ZIP code

Ohio withholding account number

Federal identifi cation number

School district name

School district number

Employee’s Social Security no.

Ohio income tax withheld

Total Ohio wages paid

Federal wages (if different from Ohio wages)

Employee’s name (fi rst, middle, last)

Total school district wages paid

School district tax withheld

Employee’s address and ZIP code

See instructions above.

Copy A – Send to: Ohio Department of Taxation, P.O. Box 2476, Columbus, OH 43216-2476.

1

1 2

2 3

3 4

4 5

5