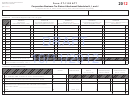

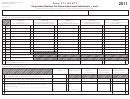

Department of Revenue Services

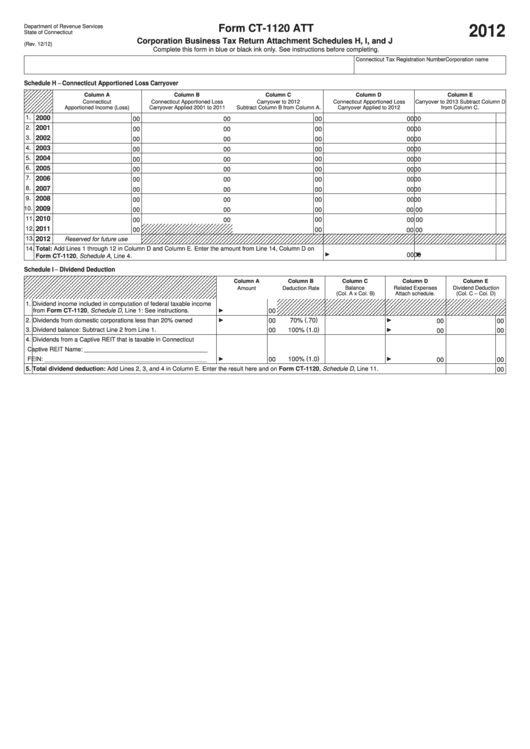

Form CT-1120 ATT

2012

State of Connecticut

Corporation Business Tax Return Attachment Schedules H, I, and J

(Rev. 12/12)

Complete this form in blue or black ink only. See instructions before completing.

Corporation name

Connecticut Tax Registration Number

Schedule H

–

Connecticut Apportioned Loss Carryover

Column A

Column B

Column C

Column D

Column E

Connecticut

Connecticut Apportioned Loss

Carryover to 2012

Connecticut Apportioned Loss

Carryover to 2013 Subtract Column D

Apportioned Income (Loss)

Carryover Applied 2001 to 2011

Subtract Column B from Column A.

Carryover Applied to 2012

from Column C.

1.

2000

00

00

00

00

00

2.

2001

00

00

00

00

00

3.

2002

00

00

00

00

00

4.

2003

00

00

00

00

00

5.

2004

00

00

00

00

00

6.

2005

00

00

00

00

00

7.

2006

00

00

00

00

00

8.

2007

00

00

00

00

00

9.

2008

00

00

00

00

00

10.

2009

00

00

00

00

00

11.

2010

00

00

00

00

00

12.

2011

00

00

00

00

13.

2012

Reserved for future use

14.

Total: Add Lines 1 through 12 in Column D and Column E. Enter the amount from Line 14, Column D on

00

00

Form CT-1120, Schedule A, Line 4. .................................................................................................................

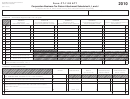

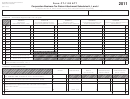

Schedule I

–

Dividend Deduction

Column A

Column B

Column C

Column D

Column E

Amount

Deduction Rate

Balance

Related Expenses

Dividend Deduction

(Col. A x Col. B)

Attach schedule.

(Col. C – Col. D)

1. Dividend income included in computation of federal taxable income

from Form CT-1120, Schedule D, Line 1: See instructions.

00

70% ( .70 )

2. Dividends from domestic corporations less than 20% owned

00

00

00

100% ( 1.0 )

3. Dividend balance: Subtract Line 2 from Line 1.

00

00

00

4. Dividends from a Captive REIT that is taxable in Connecticut

Captive REIT Name:

_________________________________________

100% ( 1.0 )

FEIN:

00

______________________________________________________

00

00

5. Total dividend deduction: Add Lines 2, 3, and 4 in Column E. Enter the result here and on Form CT-1120, Schedule D, Line 11.

00

1

1 2

2 3

3