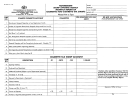

FORM M-105

(Rev. 2010)

GENERAL INSTRUCTIONS

Completely fill out the requested information. In the Name of Customer column of the table, you

must identify the person or persons, if any, to whom the cigarettes have been conveyed for resale.

Attach a separate sheet if more space is needed.

ADDITIONAL INFORMATION

Export and Foreign Cigarettes Prohibited

It is unlawful for an entity to possess, keep, store, retain, transport, sell, or offer to sell, distribute,

acquire, hold, own, import, or cause to be imported into the State any of the cigarettes described

in section 245-51, Hawaii Revised Statutes (HRS).

Stamping or Sale of Cigarettes Not Listed in the Directory Prohibited

Beginning December 1, 2003, unless the cigarette package is exempted under section 245-3(b),

HRS, it is unlawful (a) to affix a cigarette tax stamp to any cigarette package whose tobacco

product manufacturer or brand family is not listed in the directory established under chapter

486P, HRS, or (b) to import, sell, offer, keep, store, acquire, transport, distribute, receive, or

possess for sale or distribution cigarettes of a tobacco product manufacturer or brand family not

included in the directory. Any violation will be guilty of a class C felony.

To determine whether the cigarette manufacturer or brand family is listed in such directory,

please visit the Tobacco Enforcement Unit, Department of the Attorney General’s website at:

The Tobacco Enforcement Unit also may be contacted as follows:

Correspondence:

TOBACCO ENFORCEMENT UNIT

Department of the Attorney General

425 Queen Street

Honolulu, Hawaii 96813

Telephone: (808) 586-1203

When and Where to File

File this form on the first business day of the month following the month in which a

Hawaii cigarette tax stamp has been affixed to cigarettes imported into the United States. If this

date falls on a Saturday, Sunday, or holiday, it is due on the next business day. Do not file this

schedule with your Hawaii Cigarette and Tobacco Products Monthly Tax Return.

Mail two copies of this form, with attachments, to the Hawaii Department of Taxation,

P.O. Box 259, Honolulu, HI 96809-0259, Attn: Licensing Section. One of these copies will be

forwarded to the Department of the Attorney General by the Department of Taxation.

1

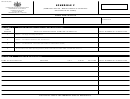

1 2

2