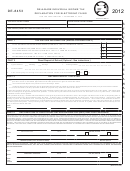

2012 Form 511EF

Oklahoma Individual Income Tax Declaration for Electronic Filing- page 2

Instructions on Requirement to Mail or Retain this Form

Most people do not mail the Form 511EF or any documentation to the Oklahoma Tax Commission

(OTC). For most taxpayers, electronic filing is a completely paperless process in Oklahoma.

However, if your return contains any of the forms or supporting schedules shown in the table below,

you are required to either mail the documentation to the OTC or send the documentation as a PDF at-

tachment with your electronically filed return. If your software does not support PDF attachments, mail

any items shown in the table below along with the Form 511EF to the address shown at the bottom of

this form.

If you are mailing the documentation, please mail with the Form 511EF as a cover page. Do not mail

your Oklahoma tax return (Form 511 or 511NR), your Federal return (Form 1040, 1040A or 1040EZ)

or withholding statements (W-2, W-2G or 1099s).

Form Number

Form Title

Form OW-8-P-SUP-I

Annualized Income Installment Method for Individuals

Form 511-NOL or 511NR-NOL

Oklahoma Net Operating Loss

Form 573

Farm Income Averaging

COFT’s Form

Oklahoma Volunteer Firefighter Tax Credit

Include a copy of other state’s income tax return if Form 511TX is filed.

Include any Oklahoma statements containing additional information.

NOTE: Do not enclose a payment with this form. If you need to make a payment, use Form 511-V

“Oklahoma Income Tax Payment Voucher” and mail to the address on the payment voucher or make

your payment electronically. For electronic payment options visit our website ( ).

Do not mail your Oklahoma tax return (Form 511 or 511NR), your Federal return (Form 1040,

1040A or 1040EZ) or withholding statements (W-2, W-2G or 1099s).

If no additional forms or documentation are required for your electronically filed return, do not mail

Form 511EF. Retain for your records.

If you are required to mail documentation and the Form 511EF to the OTC, mail to:

Oklahoma Tax Commission

Income Tax

Post Office Box 26800

Oklahoma City, OK 73126-0800

1

1 2

2