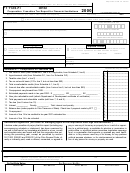

2012

Corporation name

Franchise tax I.D.#

Tax year

FT 1120FI

Rev. 6/11

Page 4

Schedule A-1 – Nonrefundable Credits

Ohio Revised

Credits must be claimed in the order listed in R.C. 5733.98

Code Section

Whole Dollars Only

(R.C.)

00

1. Credit for dealer in intangibles tax paid by member of qualifying controlled group .............5733.45

1.

00

2. Credit for savings and loan association fees .......................................................................5733.063

2.

00

3. Ethanol plant investment credit............................................................................................5733.46

3.

00

4. Credit for taxes paid by a qualifying pass-through entity .....................................................5733.0611

4.

00

5. Total nonrefundable credits. Enter here and on Schedule A, line 5 .....................................................

5.

Ohio Revised

Schedule A-2 – Refundable Credits

Code Section

(R.C.)

00

1. Refundable jobs creation credit................................................................................................. 122.17

1.

00

2. Refundable credit for tax withheld by the Ohio Lottery Commission............................ 5733.98(A)(33)

2.

00

3. Refundable Ohio historic preservation credit ...........................................................................149.311

3.

00

4. Refundable motion picture credit ............................................................................... 122.85, 5733.59

4.

00

5. Total refundable credits – enter here and on Schedule A, line 9 ..........................................................

5.

thereto are not considered fi nancial institutions, nor are they consid-

A “fi nancial institution” is any of the following:

ered dealers in intangibles. For franchise tax purposes a production

– A national bank organized and existing as a national bank as-

credit association is not a fi nancial institution. See R.C. 5725.01(A)

sociation pursuant to the National Bank Act, 12 United States

and 5733.04(K).

Code (U.S.C.) 21;

A “qualifi ed institution” is a fi nancial institution that has at least 9% of

– A federal savings association or federal savings bank that is

its deposits in Ohio as of the last day of June prior to the beginning

chartered under 12 U.S.C. 1464;

of the tax year and meets one of the following three tests:

– A bank, banking association, trust company, savings and loan

On or after June 1, 1997 the fi nancial institution has consum-

association, savings bank or other banking institution that is

mated one or more approved transactions with insured banks

incorporated or organized under the laws of any state;

with different home states that would qualify under section 102

of the Reigle-Neal Interstate Banking and Branching Effi ciency

– Any corporation organized under 12 U.S.C. 611 to 631;

Act of 1994, Public Law 103-328, 108 Stat. 2338; or

– Any agency or branch of a foreign depository as defi ned in 12

The fi nancial institution is a federal savings and loan associa-

U.S.C. 3101;

tion or federal savings bank that on or after June 1, 1997 has

consummated one or more interstate acquisitions that result in

– A company licensed as a small business investment company

a fi nancial institution that has branches in more than one state;

under the Small Business Investment Act of 1958, 72 Stat. 689,

or

15 U.S.C. 661 as amended; or

On or after June 1, 1997 the fi nancial institution has consum-

– A company chartered under the “Farm Credit Act of 1933,” 48

mated one or more approved interstate acquisitions under the

Stat. 257, 12 U.S.C. 1131(d), as amended.

authority of Title XI of the Ohio Revised Code that result in a

Insurance companies, credit unions and corporations or institutions

fi nancial institution that has branches in more than one state.

organized under the Federal Farm Loan Act and amendments

Minimum Fee Requirements

Minimum Fee

Thresholds

1. If the sum of the taxpayer’s gross receipts from activities within and without Ohio during the taxable year

$1,000

equals or exceeds $5 million; or

2. If the total number of the taxpayer’s employees within and without Ohio during the taxable year equals or

exceeds 300.

Note: In determining these thresholds, the taxpayer must include its proportionate share of the gross receipts

of any pass-through entity in which the taxpayer has a direct or indirect ownership interest and its proportionate

share of the number of employees of the pass-through entity. Gross receipts include receipts that generate

business income and nonbusiness income.

If the taxpayer’s gross receipts and number of employees did not equal or exceed the thresholds above.

$50

- 4 -

1

1 2

2 3

3 4

4