Form Mvf-3 - Terminal Operator'S Monthly Gasoline Activity Schedule

ADVERTISEMENT

Department of Revenue Services

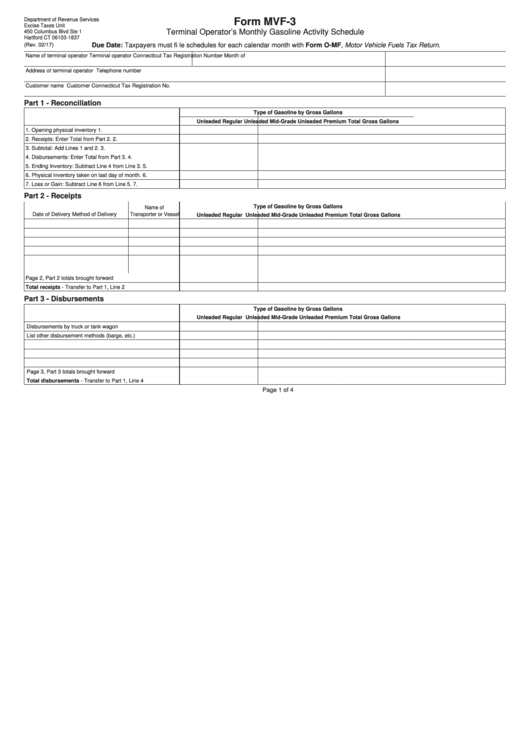

Form MVF-3

Excise Taxes Unit

Terminal Operator’s Monthly Gasoline Activity Schedule

450 Columbus Blvd Ste 1

Hartford CT 06103-1837

(Rev. 02/17)

Due Date: Taxpayers must fi le schedules for each calendar month with Form O-MF, Motor Vehicle Fuels Tax Return.

Name of terminal operator

Terminal operator Connecticut Tax Registration Number

Month of

Address of terminal operator

Telephone number

Customer name

Customer Connecticut Tax Registration No.

Part 1 - Reconciliation

Type of Gasoline by Gross Gallons

Unleaded Regular

Unleaded Mid-Grade

Unleaded Premium

Total Gross Gallons

1.

Opening physical inventory

1.

2.

Receipts: Enter Total from Part 2.

2.

3.

Subtotal: Add Lines 1 and 2.

3.

4.

Disbursements: Enter Total from Part 3.

4.

5.

Ending Inventory: Subtract Line 4 from Line 3.

5.

6.

Physical inventory taken on last day of month.

6.

7.

Loss or Gain: Subtract Line 6 from Line 5.

7.

Part 2 - Receipts

Type of Gasoline by Gross Gallons

Name of

Date of Delivery

Method of Delivery

Transporter or Vessel

Unleaded Regular

Unleaded Mid-Grade

Unleaded Premium

Total Gross Gallons

Page 2, Part 2 totals brought forward

Total receipts - Transfer to Part 1, Line 2

Part 3 - Disbursements

Type of Gasoline by Gross Gallons

Unleaded Regular

Unleaded Mid-Grade

Unleaded Premium

Total Gross Gallons

Disbursements by truck or tank wagon

List other disbursement methods (barge, etc.)

Page 3, Part 3 totals brought forward

Total disbursements - Transfer to Part 1, Line 4

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4