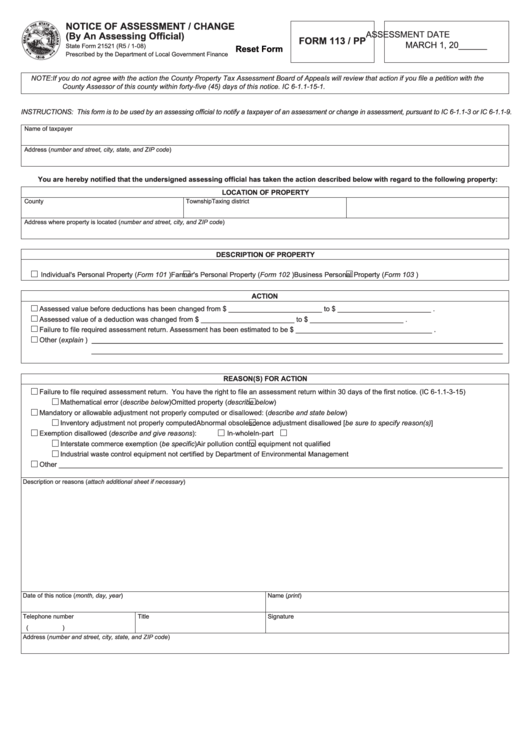

NOTICE OF ASSESSMENT / CHANGE

ASSESSMENT DATE

(By An Assessing Official)

FORM 113 / PP

MARCH 1, 20______

State Form 21521 (R5 / 1-08)

Reset Form

Prescribed by the Department of Local Government Finance

NOTE:

If you do not agree with the action the County Property Tax Assessment Board of Appeals will review that action if you file a petition with the

County Assessor of this county within forty-five (45) days of this notice. IC 6-1.1-15-1.

INSTRUCTIONS: This form is to be used by an assessing official to notify a taxpayer of an assessment or change in assessment, pursuant to IC 6-1.1-3 or IC 6-1.1-9.

Name of taxpayer

Address (number and street, city, state, and ZIP code)

You are hereby notified that the undersigned assessing official has taken the action described below with regard to the following property:

LOCATION OF PROPERTY

County

Township

Taxing district

Address where property is located (number and street, city, and ZIP code)

DESCRIPTION OF PROPERTY

Individual's Personal Property (Form 101 )

Farmer's Personal Property (Form 102 )

Business Personal Property (Form 103 )

ACTION

Assessed value before deductions has been changed from $ ________________________ to $ ________________________ .

Assessed value of a deduction was changed from $ ________________________ to $ ________________________ .

Failure to file required assessment return. Assessment has been estimated to be $ ___________________________________ .

Other (explain ) __________________________________________________________________________________________________________

__________________________________________________________________________________________________________

REASON(S) FOR ACTION

Failure to file required assessment return. You have the right to file an assessment return within 30 days of the first notice. (IC 6-1.1-3-15)

Mathematical error (describe below)

Omitted property (describe below)

Mandatory or allowable adjustment not properly computed or disallowed: (describe and state below)

Inventory adjustment not properly computed

Abnormal obsolescence adjustment disallowed [be sure to specify reason(s)]

Exemption disallowed (describe and give reasons):

In-whole

In-part

Interstate commerce exemption (be specific)

Air pollution control equipment not qualified

Industrial waste control equipment not certified by Department of Environmental Management

Other __________________________________________________________________________________________________________________

Description or reasons (attach additional sheet if necessary)

Date of this notice (month, day, year)

Name (print)

Telephone number

Title

Signature

(

)

Address (number and street, city, state, and ZIP code)

1

1