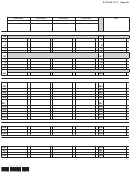

Form Ct-3-A/b - Subsidiary Detail Spreadsheet - Attachment To Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 2

ADVERTISEMENT

CT-3-A/B (2012) Page 1b

Who must file this form

on Form CT-3-A/B because subsidiary information is not required

for these lines. For line instructions, refer to the corresponding

For all combined returns and attachments, the taxpayer responsible

line instructions in Form CT-3-A-I, Instructions for Forms CT-3-A,

for filing Form CT-3-A is designated as the parent corporation. The

CT-3-A/ATT, and CT-3-A/B.

other corporations included in the combined return are designated

subsidiaries.

Include the amounts shown in the Total column on the

corresponding lines on Form CT-3-A, column B (Total subsidiaries).

Parent corporations who file a combined return that includes

more than one subsidiary must use Form CT-3-A/B to detail the

Attach all Forms CT-3-A/B to Form CT-3-A.

subsidiaries’ individual computations. If the combined group has

If you wish, you may substitute a computer printout that replicates

more than six subsidiaries, use as many additional Forms CT-3-A/B

all the information requested on Form CT-3-A/B. You may reduce

as necessary.

the printout to fit on an 8½-by-11-inch sheet of paper; however,

Instructions

the printout must be highly legible with 8 point or larger text. This

exception applies to Form CT-3-A/B and not to Form CT-3-A or

Line numbers and text for Form CT-3-A/B correspond to the line

most other corporation tax forms.

numbers of Form CT-3-A. Note that certain lines are not included

Subsidiary

Subsidiary

Subsidiary

Subsidiary

Total

EIN

EIN

EIN

EIN

Legal name of corporation

Legal name of corporation

Legal name of corporation

Legal name of corporation

1

1

2

2

3

3

4a

4a

4b

4b

5a

5a

5b

5b

6

6

7

7

8

8

11

11

12

12

14

14

15

15

23

23

26

26

27

27

28

28

29

29

30

30

31

31

436002120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10