Form Rpd-41287 12 - Calculation Of Estimated Corporate Income Tax - Penalty And Interest On Underpayment - New Mexico Taxation And Revenue Department - 2012

ADVERTISEMENT

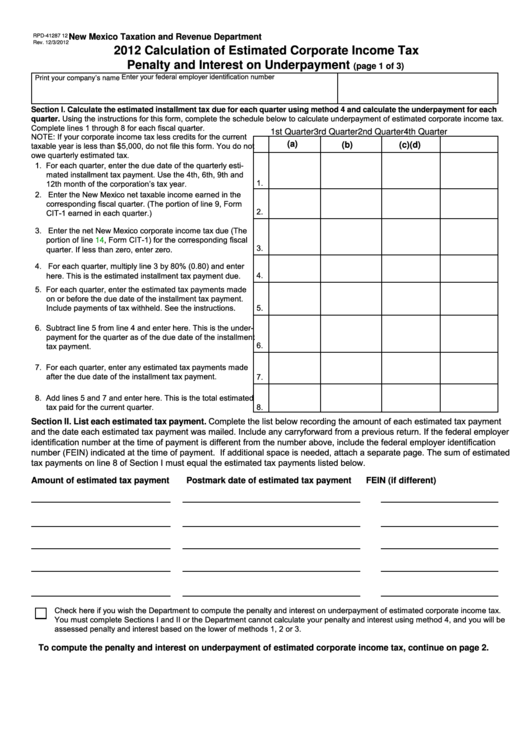

RPD-41287 12

New Mexico Taxation and Revenue Department

Rev. 12/3/2012

2012 Calculation of Estimated Corporate Income Tax

Penalty and Interest on Underpayment

(page 1 of 3)

Enter your federal employer identification number

Print your company’s name

Section I. Calculate the estimated installment tax due for each quarter using method 4 and calculate the underpayment for each

quarter. Using the instructions for this form, complete the schedule below to calculate underpayment of estimated corporate income tax.

Complete lines 1 through 8 for each fiscal quarter.

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

NOTE: If your corporate income tax less credits for the current

(a)

taxable year is less than $5,000, do not file this form. You do not

(b)

(c)

(d)

owe quarterly estimated tax.

1. For each quarter, enter the due date of the quarterly esti-

mated installment tax payment. Use the 4th, 6th, 9th and

1.

12th month of the corporation’s tax year.

2. Enter the New Mexico net taxable income earned in the

corresponding fiscal quarter. (The portion of line 9, Form

2.

CIT-1 earned in each quarter.)

3. Enter the net New Mexico corporate income tax due (The

portion of line 14, Form CIT-1) for the corresponding fiscal

3.

quarter. If less than zero, enter zero.

4. For each quarter, multiply line 3 by 80% (0.80) and enter

4.

here. This is the estimated installment tax payment due.

5. For each quarter, enter the estimated tax payments made

on or before the due date of the installment tax payment.

Include payments of tax withheld. See the instructions.

5.

6. Subtract line 5 from line 4 and enter here. This is the under-

payment for the quarter as of the due date of the installment

6.

tax payment.

7. For each quarter, enter any estimated tax payments made

after the due date of the installment tax payment.

7.

8. Add lines 5 and 7 and enter here. This is the total estimated

tax paid for the current quarter.

8.

Section II. List each estimated tax payment. Complete the list below recording the amount of each estimated tax payment

and the date each estimated tax payment was mailed. Include any carryforward from a previous return. If the federal employer

identification number at the time of payment is different from the number above, include the federal employer identification

number (FEIN) indicated at the time of payment. If additional space is needed, attach a separate page. The sum of estimated

tax payments on line 8 of Section I must equal the estimated tax payments listed below.

Amount of estimated tax payment

Postmark date of estimated tax payment

FEIN (if different)

Check here if you wish the Department to compute the penalty and interest on underpayment of estimated corporate income tax.

You must complete Sections I and II or the Department cannot calculate your penalty and interest using method 4, and you will be

assessed penalty and interest based on the lower of methods 1, 2 or 3.

To compute the penalty and interest on underpayment of estimated corporate income tax, continue on page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6