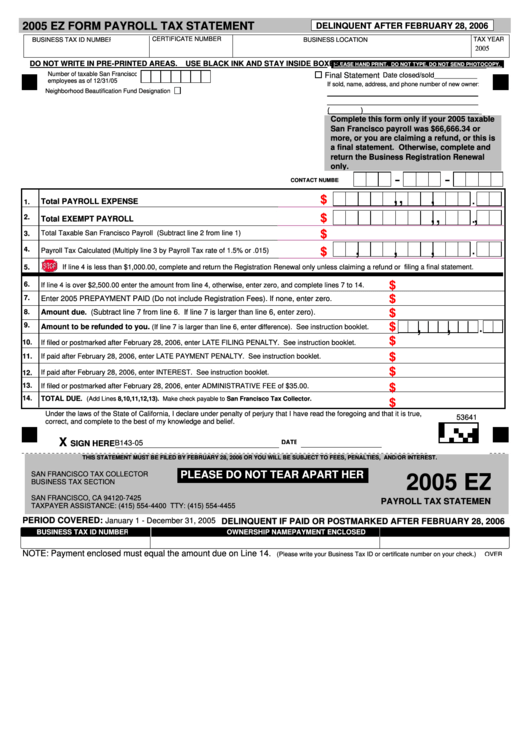

2005 EZ FORM PAYROLL TAX STATEMENT

DELINQUENT AFTER FEBRUARY 28, 2006

BUSINESS TAX ID NUMBER

CERTIFICATE NUM BER

TAX YEAR

BUSINESS LOCATION

2005

DO NOT WRITE IN PRE-PRINTED AREAS. USE BLACK INK AND STAY INSIDE BOXES.

PLEASE HAND PRINT. DO NOT TYPE. DO NOT SEND PHOTOCOPY.

Number of taxable San Francisco

Final Statement

Date closed/sold___________

employees as of 12/31/05:

If sold, name, address, and phone number of new owner:

Neighborhood Beautification Fund Designation

___________________________________

___________________________________

(_______)___________________________

Complete this form only if your 2005 taxable

San Francisco payroll was $66,666.34 or

more, or you are claiming a refund, or this is

a final statement. Otherwise, complete and

return the Business Registration Renewal

only.

-

-

CONTACT NUMBER

,

,

,

.

$

Total PAYROLL EXPENSE

1.

,

,

,

.

$

2.

Total EXEMPT PAYROLL

$

Total Taxable San Francisco Payroll (Subtract line 2 from line 1)

3.

,

,

,

.

4.

$

Payroll Tax Calculated (Multiply line 3 by Payroll Tax rate of 1.5% or .015)

If line 4 is less than $1,000.00, complete and return the Registration Renewal only unless claiming a refund or filing a final statement.

5.

$

6.

If line 4 is over $2,500.00 enter the amount from line 4, otherwise, enter zero, and complete lines 7 to 14.

$

7.

Enter 2005 PREPAYMENT PAID (Do not include Registration Fees). If none, enter zero.

$

8.

Amount due. (Subtract line 7 from line 6. If line 7 is larger than line 6, enter zero).

,

,

$

.

9.

Amount to be refunded to you.

(If line 7 is larger than line 6, enter difference). See instruction booklet.

$

10.

If filed or postmarked after February 28, 2006, enter LATE FILING PENALTY. See instruction booklet.

$

11.

If paid after February 28, 2006, enter LATE PAYMENT PENALTY. See instruction booklet.

$

12.

If paid after February 28, 2006, enter INTEREST. See instruction booklet.

13.

$

If filed or postmarked after February 28, 2006, enter ADMINISTRATIVE FEE of $35.00.

14.

TOTAL DUE.

(Add Lines 8,10,11,12,13). Make check payable to San Francisco Tax Collector.

$

Under the laws of the State of California, I declare under penalty of perjury that I have read the foregoing and that it is true,

53641

correct, and complete to the best of my knowledge and belief.

X

DATE

B143-05

SIGN HERE

THIS STATEMENT MUST BE FILED BY FEBRUARY 28, 2006 OR YOU WILL BE SUBJECT TO FEES, PENALTIES, AND/OR INTEREST.

PLEASE DO NOT TEAR APART HERE

SAN FRANCISCO TAX COLLECTOR

2005 EZ

BUSINESS TAX SECTION

P.O. BOX 7425

SAN FRANCISCO, CA 94120-7425

PAYROLL TAX STATEMENT

TAXPAYER ASSISTANCE: (415) 554-4400 TTY: (415) 554-4455

PERIOD COVERED:

January 1 - December 31, 2005

DELINQUENT IF PAID OR POSTMARKED AFTER FEBRUARY 28, 2006

BUSINESS TAX ID NUMBER

OWNERSHIP NAME

PAYMENT ENCLOSED

NOTE: Payment enclosed must equal the amount due on Line 14.

OVER

(Please write your Business Tax ID or certificate number on your check.)

1

1