Form Rpd-41249 12 - Notice Of Approval Of A Qualified Employer - State Of New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

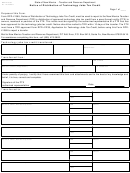

State of New Mexico – Taxation and Revenue Department

RPD-41249 12

Rev. 09/25/2012

Notice of Approval of a Qualified Employer

for Allocation of Nonresident Employee Income

from Manufacturing Plants in New Mexico Within 20 Miles of

International Border (Section 7-2-11 NMSA 1978)

Calendar Year 2012 –

page 2 of 2

Instructions for the nonresident employee: In tax year 2012 employees who are not residents of New Mexico and who

are employed at an approved plant may allocate income earned at the plant to their state of residence for state income tax

purposes. The election applies only to income earned at the business location specified on page 1 of this form. Other income

from New Mexico sources must be allocated and apportioned to New Mexico. For example, wages earned from employ-

ment at a New Mexico business that has not been approved or otherwise does not qualify as an eligible employer must be

allocated to New Mexico. Income from all other New Mexico sources must be allocated to New Mexico. Maintain a copy of

this form in your records and submit a copy with your New Mexico personal income tax (PIT-1) return.

To allocate income earned at the qualified business location to your state of residence, you must file a PIT-B schedule with

your New Mexico PIT-1 Personal Income Tax return. Report all income from wages everywhere on PIT-B line 1, column 1.

When completing line 1, column 2, exclude the wages earned at the qualified manufacturing plant. Continue to complete

the Schedule PIT-B as per the instructions provided with that form. IMPORTANT: Submit a copy of Form RPD-41249 12

with your New Mexico income tax return to document that no New Mexico income tax is due from your employment

at this plant.

How withholding tax requirements are affected: New Mexico employers must withhold from wages of New Mexico resi-

dents if required to withhold for federal purposes. New Mexico also requires withholding from the wages of any nonresident

employee who has worked in New Mexico for a total of 15 days in a calendar year and who is subject to a federal withhold-

ing requirement. Once a manufacturing plant is approved as qualified, the nonresident employees of that plant may elect

to allocate or apportion the wages earned at the qualified manufacturing plant to the state of residency. The federal income

tax withholding will not be affected by this election, but the employee may wish to change his or her withholding for state

purposes. The employee may contact the employer about a change in New Mexico withholding only. When the employer’s

qualified period has expired, the employee should review his or her New Mexico withholding requirements because the income

earned at the plant will then be subject to New Mexico income tax. The New Mexico Taxation and Revenue Department will

perform random audits of persons filing this form, Notice of Approval of a Qualified Employer for Allocation of Nonresident

Employee Income from Manufacturing Plants in New Mexico Within 20 Miles of International Border. You may be asked to

verify your residency status.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2