Form Eqr - Employer'S Quarterly Return Of Tax Withheld - Village Of Mantua

ADVERTISEMENT

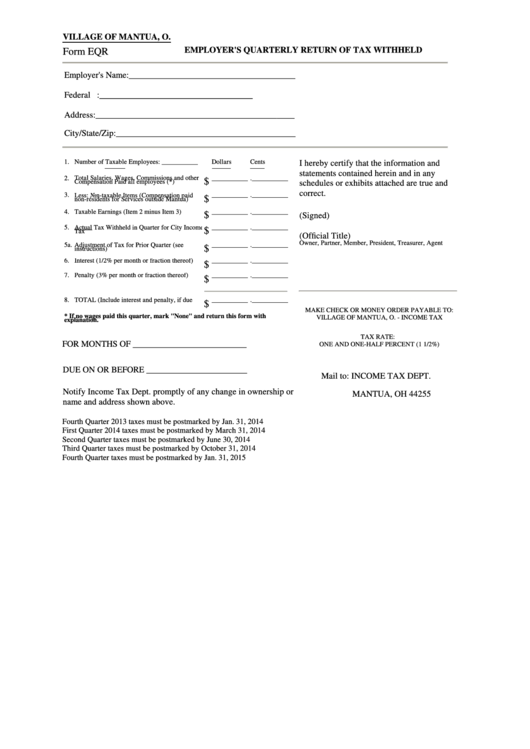

VILLAGE OF MANTUA, O.

Form EQR

EMPLOYER'S QUARTERLY RETURN OF TAX WITHHELD

Employer's Name:______________________________________

Federal I.D. number:___________________________________

Address:_____________________________________________

City/State/Zip:_________________________________________

I hereby certify that the information and

.

1. Number of Taxable Employees: ___________

Dollars

Cents

statements contained herein and in any

Total Salaries, Wages, Commissions and other

$

2.

___________ .___________

schedules or exhibits attached are true and

Compensation Paid all employees (*)

correct.

Less: Non-taxable Items (Compensation paid

$

3.

___________ .___________

non-residents for Services outside Mantua)

$

4. Taxable Earnings (Item 2 minus Item 3)

___________ .___________

(Signed) .....................................................

Actual Tax Withheld in Quarter for City Income

$

5.

___________ .___________

Tax

(Official Title) .............................................

Adjustment of Tax for Prior Quarter (see

Owner, Partner, Member, President, Treasurer, Agent

$

5a.

___________ .___________

instructions)

$

6. Interest (1/2% per month or fraction thereof)

___________ .___________

Date........................................................

$

7. Penalty (3% per month or fraction thereof)

___________ .___________

.

.

$

8. TOTAL (Include interest and penalty, if due

___________ .___________

MAKE CHECK OR MONEY ORDER PAYABLE TO:

* If no wages paid this quarter, mark "None" and return this form with

VILLAGE OF MANTUA, O. - INCOME TAX

explanation.

TAX RATE:

FOR MONTHS OF __________________________

ONE AND ONE-HALF PERCENT (1 1/2%)

DUE ON OR BEFORE _______________________

Mail to: INCOME TAX DEPT.

P.O. Box 775

Notify Income Tax Dept. promptly of any change in ownership or

MANTUA, OH 44255

name and address shown above.

Fourth Quarter 2013 taxes must be postmarked by Jan. 31, 2014

First Quarter 2014 taxes must be postmarked by March 31, 2014

Second Quarter taxes must be postmarked by June 30, 2014

Third Quarter taxes must be postmarked by October 31, 2014

Fourth Quarter taxes must be postmarked by Jan. 31, 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1