PART II

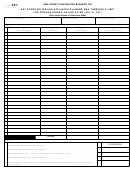

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

8. Tax Credits taken on current year’s return:

a) Urban Transit Hub Tax Credit . . . . . . . . . . . . . . .__________________________

b) Grow New Jersey Tax Credit . . . . . . . . . . . . . . .__________________________

c) HMO Assistance Fund Tax Credit . . . . . . . . . . . .__________________________

d) New Jobs Investment Tax Credit . . . . . . . . . . . .__________________________

e) Urban Enterprise Zone Tax Credit . . . . . . . . . . .__________________________

f) Redevelopment Authority Project Tax Credit . . .__________________________

g) Recycling Equipment Tax Credit . . . . . . . . . . . . .__________________________

h) Manufacturing Equipment and Employment

Investment Tax Credit . . . . . . . . . . . . . . . . . . . . .__________________________

i) Research and Development Tax Credit . . . . . . .__________________________

j) Small New Jersey-Based High-Technology

Business Investment Tax Credit . . . . . . . . . . . . .__________________________

k) Neighborhood Revitalization State Tax Credit . .__________________________

l) Effluent Equipment Tax Credit . . . . . . . . . . . . . .__________________________

m)Economic Recovery Tax Credit . . . . . . . . . . . . . .__________________________

n) Remediation Tax Credit . . . . . . . . . . . . . . . . . . . .__________________________ . . . . . . . . . .Total

8.

9. Subtract line 8 from line 7. If the result is less than zero, enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Allowable credit for the current tax period - Enter the lesser of line 9 or Part I, line 4 here and on

Schedule A-3 of the CBT-100, the BFC-1, or the CBT-100S . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

Instructions for Form 315

AMA Tax Credit

For taxable periods beginning on or after January 1, 2002, if a taxpayer incurs an AMA (Alternative Minimum Assessment) liability in excess of

the regular CBT liability, the excess may be carried over to subsequent years and used as a credit against the regular CBT liability. The

carryovers never expire. There are, however, limitations as to how much credit can be taken on any single return. The credit taken shall not

reduce the taxpayer’s CBT liability to less than the Alternative Minimum Assessment, nor to below 50% of the regular CBT liability otherwise

due, nor to below the minimum tax due ($500 or $2,000). In addition, all other credits available to the taxpayer per Schedule A-3 must be

used before taking the AMA Tax Credit. If a key corporation is remitting AMA for a controlled group, only the key corporation may take the

AMA Tax Credit.

New Jersey S corporations which formerly filed as C corporations and had an AMA liability can take the AMA credit on the CBT-100S tax return

subject to the same rules as stated above.

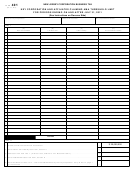

PART I

AMA Tax Credit Carryover

Line 1 -

For each year, subtract the regular CBT liability from the AMA liability and enter the difference in the appropriate column. If

CBT is higher than AMA enter zero. Note: line 1, column A, enter the cumulative tax credit calculated for tax years 2002

through 2005.

Line 2 -

For each year, enter the amount of AMA Tax Credit used. If credit not used, enter zero. Note: line 2a, enter the cumulative tax

credit amount used for tax years 2003 through 2007.

Line 3 -

For each column, subtract the total of all of the amounts in line 2 from line 1.

Line 4 -

Enter the total of all amounts reported on line 3.

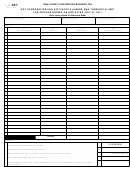

PART II

Calculation of Allowable Credit Amount

Line 1 -

Enter the current tax year’s regular CBT liability before application of tax credits.

Line 2 -

Enter the minimum tax liability. Refer to CBT-100 or BFC-1, instruction 11(d), or CBT-100S, instruction 10(d).

Line 5 -

Enter the current tax year’s AMA liability from page 1, line 12 of CBT-100 or BFC-1. If the taxpayer is a key corporation

remitting AMA for a controlled group, enter the amount on page 1, line 14 of CBT-100 or BFC-1.

Line 8 -

Enter tax credit amounts as reported on Schedule A-3 of CBT-100, BFC-1, or CBT-100S.

Form 315 (09-12, R-7)

Page 2

1

1 2

2