Department of Revenue Services

For Period Ending

PO Box 5031

Hartford CT 06102-5031

(New 04/12)

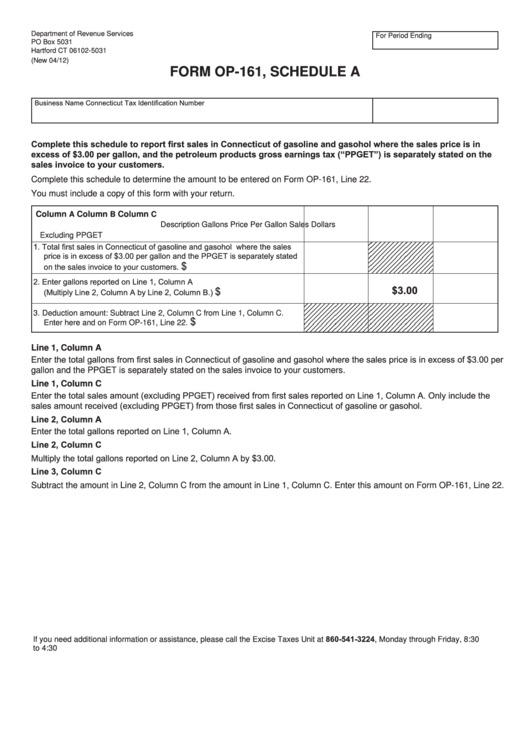

FORM OP-161, SCHEDULE A

Business Name

Connecticut Tax Identification Number

Complete this schedule to report first sales in Connecticut of gasoline and gasohol where the sales price is in

excess of $3.00 per gallon, and the petroleum products gross earnings tax (“PPGET”) is separately stated on the

sales invoice to your customers.

Complete this schedule to determine the amount to be entered on Form OP-161, Line 22.

You must include a copy of this form with your return.

Column

Column

Column

A

B

C

Description

Gallons

Price Per Gallon

Sales Dollars

Excluding PPGET

1. Total first sales in Connecticut of gasoline and gasohol where the sales

price is in excess of $3.00 per gallon and the PPGET is separately stated

$

on the sales invoice to your customers.

2. Enter gallons reported on Line 1, Column A

$3.00

$

(Multiply Line 2, Column A by Line 2, Column B.)

3. Deduction amount: Subtract Line 2, Column C from Line 1, Column C.

$

Enter here and on Form OP-161, Line 22.

Line 1, Column A

Enter the total gallons from first sales in Connecticut of gasoline and gasohol where the sales price is in excess of $3.00 per

gallon and the PPGET is separately stated on the sales invoice to your customers.

Line 1, Column C

Enter the total sales amount (excluding PPGET) received from first sales reported on Line 1, Column A. Only include the

sales amount received (excluding PPGET) from those first sales in Connecticut of gasoline or gasohol.

Line 2, Column A

Enter the total gallons reported on Line 1, Column A.

Line 2, Column C

Multiply the total gallons reported on Line 2, Column A by $3.00.

Line 3, Column C

Subtract the amount in Line 2, Column C from the amount in Line 1, Column C. Enter this amount on Form OP-161, Line 22.

If you need additional information or assistance, please call the Excise Taxes Unit at 860-541-3224, Monday through Friday, 8:30 a.m.

to 4:30 p.m.

1

1