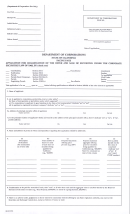

Application instructions

• You must complete all sections.

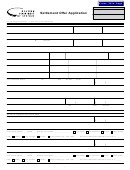

Section 4. Asset and debt analysis

• Don’t fill in shaded boxes.

Lines 2–7, enter totals from Section 3.

• Attach additional pages if necessary.

Lines 17–18, don’t include everyday household items

such as clothing, furniture, appliances, etc.

• Print clearly.

Lines 20–22, include properties listed in Section 3. To

determine current property value, use the real market

Section 1. Personal information

value (RMV) from your most recent property tax state-

Fill out completely and include all members of your

ment.

household.

Line 27, include unsecured credit balance from Section

3 only if you filled it in.

Section 2. Employment information

Lines 30–32, explain other debts and provide support-

There are two sections: one for your employment infor-

ing documentation.

mation and one for your spouse/registered domestic

partner (RDP) employment information.

Section 5. Monthly income and expense analysis

Provide the name of your employer, or the name of

• Important—If you work on commission or own

your business if you’re self-employed.

a business, we may ask you for more than three

Check the “paid” box that applies to how frequently

months pay stubs.

you get a pay check.

Fill in gross and net amounts, except where boxes are

• Important—Include the number of allowances you

shaded.

claim on your most recent W-4 form.

Line 50, explain other income and provide supporting

documentation.

Section 3. General financial information–

Lines 52–68, provide proof of monthly payments for

personal and business

each expense.

Bank accounts—List all bank accounts. For the total dol-

Lines 70–77, provide proof of monthly payments for

lar amount in your accounts, add together only those

each business-related expense.

accounts with positive balances.

• Important—For any bank accounts with negative

Section 6. Settlement offer calculations

balances, enter -0-.

Line 83, disposable income formula.

Example: Bob has three bank accounts:

Example: Anne’s net disposable income from line 81

1. Checking account 1

$400.00

is $1,500. She enters $1,500 on line 82 and multiplies

it by 36.0.

2. Checking account 2

–$100.00

$1,500 x 36.0 = $54,000

3. Savings account

$600.00

She enters $54,000 on line 83.

He lists all three accounts and enters -0- in the Bal-

ance column for checking account 2. The total of his

Line 85, assets and equity formula.

bank accounts is $1,000; not $900.

Example: Anne’s total value of all immediate assets

Personal property—If you own a business, include only

and real property equity from line 26 is $3,000. She

personal property not used in your business.

enters that on line 84 and multiplies it by 0.75.

Credit cards and unsecured lines of credit—We don’t allow

$3,000 x 0.75 = $2,250.

these expenses when we determine your ability to pay.

She enters $2,250 on line 85.

Other financial information—Include any court proceed-

ings that resulted in or may result in a financial judg-

Line 86, add lines 83 and 85 to get your settlement offer

amount.

ment in your favor.

4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16