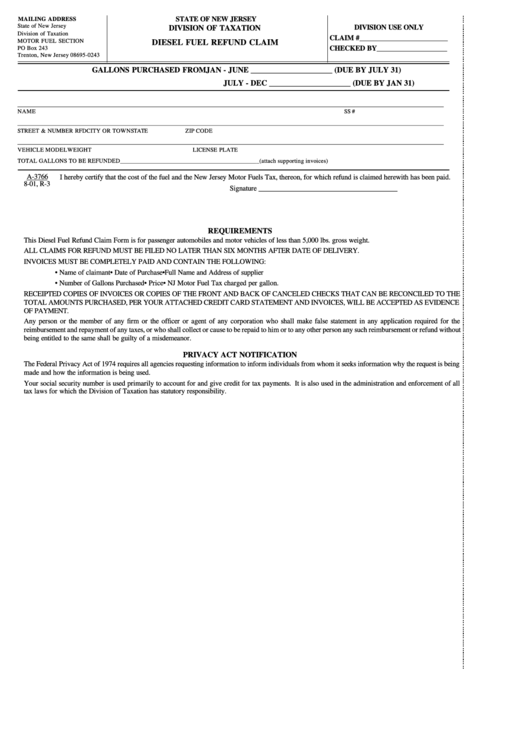

STATE OF NEW JERSEY

MAILING ADDRESS

State of New Jersey

DIVISION USE ONLY

DIVISION OF TAXATION

Division of Taxation

CLAIM #_________________________

MOTOR FUEL SECTION

DIESEL FUEL REFUND CLAIM

PO Box 243

CHECKED BY____________________

Trenton, New Jersey 08695-0243

GALLONS PURCHASED FROM

JAN - JUNE _____________________ (DUE BY JULY 31)

JULY - DEC _____________________ (DUE BY JAN 31)

_____________________________________________________________________________________________________________________________________________

NAME

SS #

_____________________________________________________________________________________________________________________________________________

STREET & NUMBER RFD

CITY OR TOWN

STATE

ZIP CODE

_____________________________________________________________________________________________________________________________________________

VEHICLE MODEL

WEIGHT

LICENSE PLATE

TOTAL GALLONS TO BE REFUNDED______________________________________________(attach supporting invoices)

A-3766

I hereby certify that the cost of the fuel and the New Jersey Motor Fuels Tax, thereon, for which refund is claimed herewith has been paid.

8-01, R-3

Signature _______________________________________

REQUIREMENTS

This Diesel Fuel Refund Claim Form is for passenger automobiles and motor vehicles of less than 5,000 lbs. gross weight.

ALL CLAIMS FOR REFUND MUST BE FILED NO LATER THAN SIX MONTHS AFTER DATE OF DELIVERY.

INVOICES MUST BE COMPLETELY PAID AND CONTAIN THE FOLLOWING:

• Name of claimant

• Date of Purchase

•Full Name and Address of supplier

• Number of Gallons Purchased

• Price

• NJ Motor Fuel Tax charged per gallon.

RECEIPTED COPIES OF INVOICES OR COPIES OF THE FRONT AND BACK OF CANCELED CHECKS THAT CAN BE RECONCILED TO THE

TOTAL AMOUNTS PURCHASED, PER YOUR ATTACHED CREDIT CARD STATEMENT AND INVOICES, WILL BE ACCEPTED AS EVIDENCE

OF PAYMENT.

Any person or the member of any firm or the officer or agent of any corporation who shall make false statement in any application required for the

reimbursement and repayment of any taxes, or who shall collect or cause to be repaid to him or to any other person any such reimbursement or refund without

being entitled to the same shall be guilty of a misdemeanor.

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974 requires all agencies requesting information to inform individuals from whom it seeks information why the request is being

made and how the information is being used.

Your social security number is used primarily to account for and give credit for tax payments. It is also used in the administration and enforcement of all

tax laws for which the Division of Taxation has statutory responsibility.

1

1