Form 941n - Nebraska Withholding Return

ADVERTISEMENT

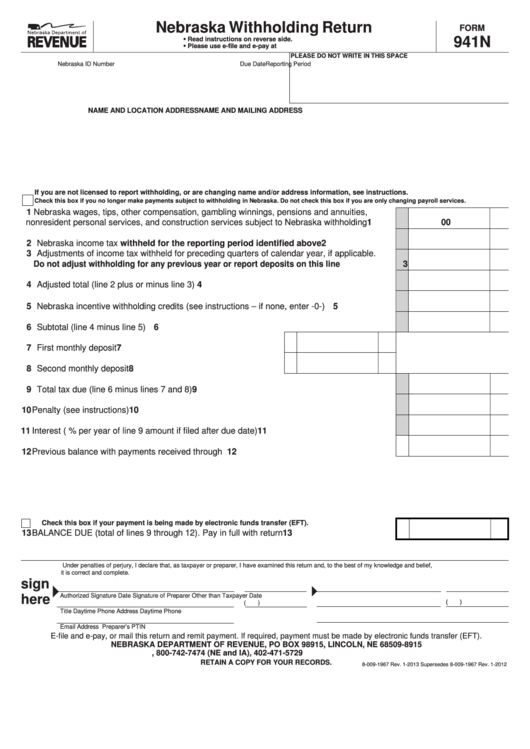

Nebraska Withholding Return

FORM

• Read instructions on reverse side.

941N

• Please use e-file and e-pay at

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska ID Number

Reporting Period

Due Date

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

If you are not licensed to report withholding, or are changing name and/or address information, see instructions.

Check this box if you no longer make payments subject to withholding in Nebraska. Do not check this box if you are only changing payroll services.

1 Nebraska wages, tips, other compensation, gambling winnings, pensions and annuities,

nonresident personal services, and construction services subject to Nebraska withholding .......

1

00

2 Nebraska income tax withheld for the reporting period identified above...............................

2

3 Adjustments of income tax withheld for preceding quarters of calendar year, if applicable.

Do not adjust withholding for any previous year or report deposits on this line ......................

3

4 Adjusted total (line 2 plus or minus line 3) ..................................................................................

4

5 Nebraska incentive withholding credits (see instructions – if none, enter -0-) .............................

5

6 Subtotal (line 4 minus line 5) ........................................................................................................

6

7 First monthly deposit ...................................................................... 7

8 Second monthly deposit ................................................................. 8

9 Total tax due (line 6 minus lines 7 and 8) .....................................................................................

9

10 Penalty (see instructions) ............................................................................................................. 10

11 Interest (

% per year of line 9 amount if filed after due date) .......................................... 11

12 Previous balance with payments received through

12

Check this box if your payment is being made by electronic funds transfer (EFT).

13 BALANCE DUE (total of lines 9 through 12). Pay in full with return ............................................. 13

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this return and, to the best of my knowledge and belief,

it is correct and complete.

sign

Authorized Signature

Date

Signature of Preparer Other than Taxpayer

Date

here

(

)

(

)

Title

Daytime Phone

Address

Daytime Phone

Email Address

Preparer’s PTIN

E-file and e-pay, or mail this return and remit payment. If required, payment must be made by electronic funds transfer (EFT).

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98915, LINCOLN, NE 68509-8915

, 800-742-7474 (NE and IA), 402-471-5729

RETAIN A COPY FOR YOUR RECORDS.

8-009-1967 Rev. 1-2013 Supersedes 8-009-1967 Rev. 1-2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2