Form Wh-1u - Underpayment Form

Download a blank fillable Form Wh-1u - Underpayment Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Wh-1u - Underpayment Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

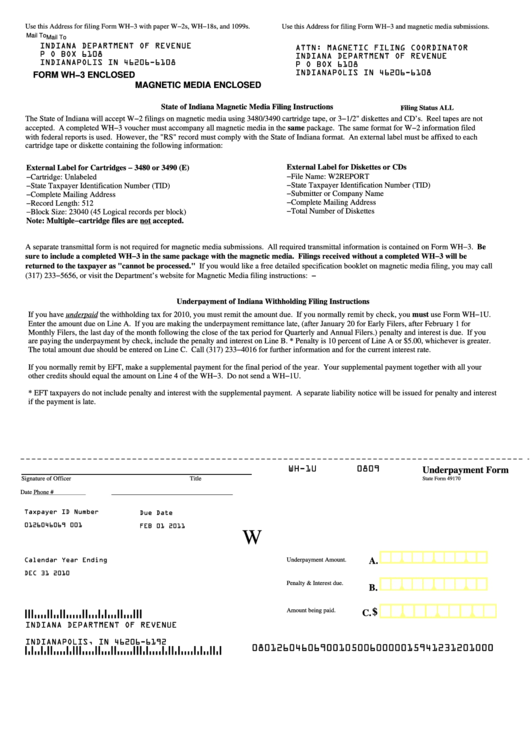

Use this Address for filing Form WH−3 with paper W−2s, WH−18s, and 1099s.

Use this Address for filing Form WH−3 and magnetic media submissions.

Mail To

Mail To

INDIANA DEPARTMENT OF REVENUE

ATTN: MAGNETIC FILING COORDINATOR

P O BOX 6108

INDIANA DEPARTMENT OF REVENUE

INDIANAPOLIS IN 46206-6108

P O BOX 6108

INDIANAPOLIS IN 46206-6108

FORM WH−3 ENCLOSED

MAGNETIC MEDIA ENCLOSED

State of Indiana Magnetic Media Filing Instructions

Filing Status ALL

The State of Indiana will accept W−2 filings on magnetic media using 3480/3490 cartridge tape, or 3−1/2" diskettes and CD’s. Reel tapes are not

accepted. A completed WH−3 voucher must accompany all magnetic media in the same package. The same format for W−2 information filed

with federal reports is used. However, the "RS" record must comply with the State of Indiana format. An external label must be affixed to each

cartridge tape or diskette containing the following information:

External Label for Diskettes or CDs

External Label for Cartridges − 3480 or 3490 (E)

−File Name: W2REPORT

−Cartridge: Unlabeled

−State Taxpayer Identification Number (TID)

−State Taxpayer Identification Number (TID)

−Submitter or Company Name

−Complete Mailing Address

−Complete Mailing Address

−Record Length: 512

−Total Number of Diskettes

−Block Size: 23040 (45 Logical records per block)

Note: Multiple−cartridge files are not accepted.

A separate transmittal form is not required for magnetic media submissions. All required transmittal information is contained on Form WH−3. Be

sure to include a completed WH−3 in the same package with the magnetic media. Filings received without a completed WH−3 will be

returned to the taxpayer as "cannot be processed." If you would like a free detailed specification booklet on magnetic media filing, you may call

(317) 233−5656, or visit the Department’s website for Magnetic Media filing instructions:

Underpayment of Indiana Withholding Filing Instructions

If you have underpaid the withholding tax for 2010, you must remit the amount due. If you normally remit by check, you must use Form WH−1U.

Enter the amount due on Line A. If you are making the underpayment remittance late, (after January 20 for Early Filers, after February 1 for

Monthly Filers, the last day of the month following the close of the tax period for Quarterly and Annual Filers.) penalty and interest is due. If you

are paying the underpayment by check, include the penalty and interest on Line B. * Penalty is 10 percent of Line A or $5.00, whichever is greater.

The total amount due should be entered on Line C. Call (317) 233−4016 for further information and for the current interest rate.

If you normally remit by EFT, make a supplemental payment for the final period of the year. Your supplemental payment together with all your

other credits should equal the amount on Line 4 of the WH−3. Do not send a WH−1U.

* EFT taxpayers do not include penalty and interest with the supplemental payment. A separate liability notice will be issued for penalty and interest

if the payment is late.

− − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − − −

WH-1U

0809

Underpayment Form

Signature of Officer

Title

State Form 49170

Date

Phone #

Taxpayer ID Number

Due Date

0126046069 001

FEB 01 2011

W

A.

Calendar Year Ending

Underpayment Amount.

DEC 31 2010

Penalty & Interest due.

B.

(0603211(

Amount being paid.

$

C.

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 6192

INDIANAPOLIS, IN 46206-6192

080126046069001050060000015941231201000

(462066192923(

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1