Form Bi-158 - Initial Application For Registration Of Bingo Distributor Page 4

ADVERTISEMENT

STATE OF KANSAS

DEPARTMENT OF REVENUE

Kansas Department of Revenue

Phone: (785) 296-6127

Docking State Office Building, Room 214

Fax: (785) 296-7185

915 SW Harrison Street

Hearing Impaired TTY: (785) 296-3909

Topeka, KS 66625-3512

E-mail Address: phil_wilkes@kdor.state.ks.us

Charitable Gaming

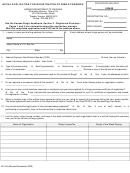

INSTRUCTIONS FOR INITIAL APPLICATION FOR

REGISTRATION OF BINGO DISTRIBUTOR

The Initial Application for Registration of Bingo Distributor (Form BI-158) must be submitted to the Kansas

Department of Revenue and a Registration Certificate issued by the Department before any person or business may

sell or distribute any disposable paper bingo cards or instant bingo tickets (pull-tabs) to nonprofit organizations

licensed to conduct bingo games in Kansas. Manufacturers and other suppliers, which merely sell or distribute

these items to other distributors, should not register. The law prohibits registration of any business if any owner,

manager or employee thereof has, within five years prior to registration, been convicted of or pleaded guilty or no

contest to any felony or illegal gambling violation in this or any other jurisdiction.

All items on the application must be completed and the signature of the owner, partner or corporate officer signing

at the bottom of the reverse side must be properly notarized. Each application must be accompanied by a $500

registration fee. You must also enclose a $1,000 bond to secure payment of the excise tax on the disposable paper

bingo cards and instant bingo tickets, which you will be required to collect and remit to the Department. Payment

of the fee and the bond should be made in the form of one check or money order made payable to the "Kansas

Department of Revenue." Please do not send cash. If your application is approved, a Registration Certificate will

be mailed to you. If your application is not approved, the fee and bond will be returned to you with an explanation

for the disapproval.

Enclosed is a booklet of Kansas bingo laws and regulations. You should review and become familiar with all of

the laws and regulations, but particularly the provisions which apply to bingo distributors, as follows:

K.S.A. 79-4701, subsections (i) and (j) - definitions.

K.S.A. 79-4704, subsections (b), (c) and (d) - collection of tax; payment of bond.

K.S.A. 79-4705, subsections (c) and (d) - filing of tax returns.

K.S.A. 79-4706, subsections (w), (x) and (y) - requirements for instant bingo tickets and packaging.

K.S.A. 79-4712a - registration of bingo distributors.

K.S.A. 79-4713 - fines for violation of laws and regulations.

Before you sell disposable paper bingo cards or instant bingo tickets to anyone in the State of Kansas, you should

require that person to provide proof that they are an official representative of a nonprofit organization which is

currently licensed to conduct bingo games by the Kansas Department of Revenue. If a person claims to be exempt

from licensing, you should verify this fact with the Administrator of Charitable Gaming before selling to that

person.

If you have questions regarding the Initial Application for Registration of Bingo Distributor or need additional

information, please write to the Administrator of Charitable Gaming at the address above or call in Topeka 785-

296-6127.

BI-158a (Revised April 2002)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4