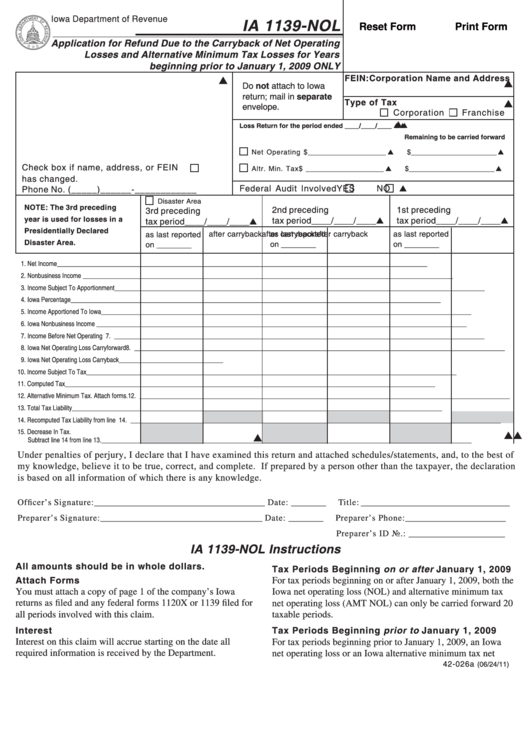

Iowa Department of Revenue

IA 1139-NOL

Reset Form

Print Form

Application for Refund Due to the Carryback of Net Operating

Losses and Alternative Minimum Tax Losses for Years

beginning prior to January 1, 2009 ONLY

Corporation Name and Address

FEIN:

Do not attach to Iowa

return; mail in separate

Type of Tax

envelope.

Corporation

Franchise

Loss Return for the period ended ____/____/____

Remaining to be carried forward

Net Operating $ ____________________

$ ______________________

Check box if name, address, or FEIN

Altr. Min. Tax $ ____________________

$ ______________________

has changed.

Federal Audit Involved

YES

NO

Phone No. (_____)______-____________

Disaster Area

NOTE: The 3rd preceding

2nd preceding

1st preceding

3rd preceding

year is used for losses in a

tax period____/____/____

tax period____/____/____

tax period____/____/____

Presidentially Declared

after carryback

as last reported

after carryback

as last reported

after carryback

as last reported

Disaster Area.

on ________

on ________

on ________

1. Net Income ............................................ 1. _____________________________________________________________________________________________________________________

2. Nonbusiness Income ............................. 2. _____________________________________________________________________________________________________________________

3. Income Subject To Apportionment ........ 3. _____________________________________________________________________________________________________________________

4. Iowa Percentage .................................... 4. _____________________________________________________________________________________________________________________

5. Income Apportioned To Iowa ................ 5. _____________________________________________________________________________________________________________________

6. Iowa Nonbusiness Income .................... 6. _____________________________________________________________________________________________________________________

7. Income Before Net Operating Losses ... 7. _____________________________________________________________________________________________________________________

8. Iowa Net Operating Loss Carryforward

8. _____________________________________________________________________________________________________________________

9. Iowa Net Operating Loss Carryback ..... 9. _____________________________________________________________________________________________________________________

10. Income Subject To Tax ........................... 10. _____________________________________________________________________________________________________________________

11. Computed Tax ........................................ 11. _____________________________________________________________________________________________________________________

12. Alternative Minimum Tax. Attach forms. 12. _____________________________________________________________________________________________________________________

13. Total Tax Liability .................................... 13. _____________________________________________________________________________________________________________________

14. Recomputed Tax Liability from line 13. .. 14. _____________________________________________________________________________________________________________________

15. Decrease In Tax.

Subtract line 14 from line 13. ................. 15. _____________________________________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this return and attached schedules/statements, and, to the best of

my knowledge, believe it to be true, correct, and complete. If prepared by a person other than the taxpayer, the declaration

is based on all information of which there is any knowledge.

Officer’s Signature: _______________________________________ Date: ________

Title: __________________________________

Preparer’s Signature: _____________________________________ Date: ________

Preparer’s Phone: _______________________

Preparer’s ID No.: ______________________

IA 1139-NOL Instructions

All amounts should be in whole dollars.

Tax Periods Beginning on or after January 1, 2009

Attach Forms

For tax periods beginning on or after January 1, 2009, both the

You must attach a copy of page 1 of the company’s Iowa

Iowa net operating loss (NOL) and alternative minimum tax

returns as filed and any federal forms 1120X or 1139 filed for

net operating loss (AMT NOL) can only be carried forward 20

all periods involved with this claim.

taxable periods.

Interest

Tax Periods Beginning prior to January 1, 2009

Interest on this claim will accrue starting on the date all

For tax periods beginning prior to January 1, 2009, an Iowa

required information is received by the Department.

net operating loss or an Iowa alternative minimum tax net

42-026a

(06/24/11)

1

1 2

2