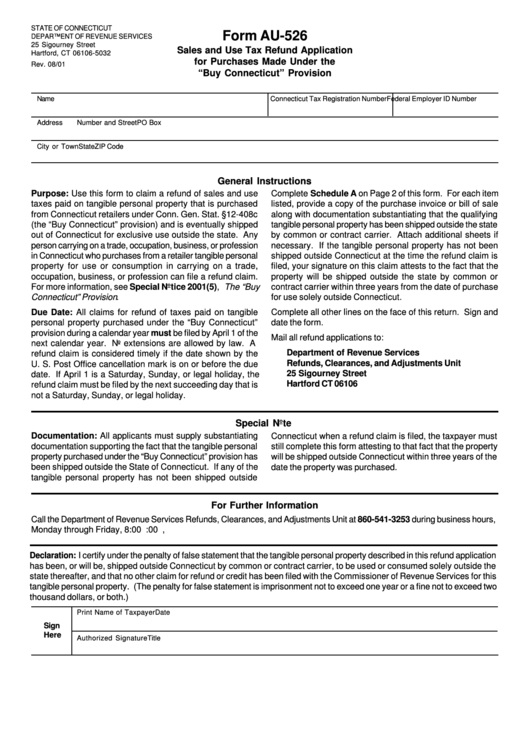

STATE OF CONNECTICUT

Form AU-526

DEPARTMENT OF REVENUE SERVICES

25 Sigourney Street

Sales and Use Tax Refund Application

Hartford, CT 06106-5032

for Purchases Made Under the

Rev. 08/01

“Buy Connecticut” Provision

Name

Connecticut Tax Registration Number

Federal Employer ID Number

Address

Number and Street

PO Box

City or Town

State

ZIP Code

General Instructions

Purpose: Use this form to claim a refund of sales and use

Complete Schedule A on Page 2 of this form. For each item

taxes paid on tangible personal property that is purchased

listed, provide a copy of the purchase invoice or bill of sale

from Connecticut retailers under Conn. Gen. Stat. §12-408c

along with documentation substantiating that the qualifying

(the “Buy Connecticut” provision) and is eventually shipped

tangible personal property has been shipped outside the state

out of Connecticut for exclusive use outside the state. Any

by common or contract carrier. Attach additional sheets if

person carrying on a trade, occupation, business, or profession

necessary. If the tangible personal property has not been

in Connecticut who purchases from a retailer tangible personal

shipped outside Connecticut at the time the refund claim is

property for use or consumption in carrying on a trade,

filed, your signature on this claim attests to the fact that the

occupation, business, or profession can file a refund claim.

property will be shipped outside the state by common or

For more information, see Special Notice 2001(5), The “Buy

contract carrier within three years from the date of purchase

Connecticut” Provision .

for use solely outside Connecticut.

Due Date: All claims for refund of taxes paid on tangible

Complete all other lines on the face of this return. Sign and

personal property purchased under the “Buy Connecticut”

date the form.

provision during a calendar year must be filed by April 1 of the

Mail all refund applications to:

next calendar year. No extensions are allowed by law. A

Department of Revenue Services

refund claim is considered timely if the date shown by the

Refunds, Clearances, and Adjustments Unit

U. S. Post Office cancellation mark is on or before the due

25 Sigourney Street

date. If April 1 is a Saturday, Sunday, or legal holiday, the

Hartford CT 06106

refund claim must be filed by the next succeeding day that is

not a Saturday, Sunday, or legal holiday.

Special Note

Documentation: All applicants must supply substantiating

Connecticut when a refund claim is filed, the taxpayer must

documentation supporting the fact that the tangible personal

still complete this form attesting to that fact that the property

property purchased under the “Buy Connecticut” provision has

will be shipped outside Connecticut within three years of the

been shipped outside the State of Connecticut. If any of the

date the property was purchased.

tangible personal property has not been shipped outside

For Further Information

Call the Department of Revenue Services Refunds, Clearances, and Adjustments Unit at 860-541-3253 during business hours,

Monday through Friday, 8:00 a.m. to 5:00 p.m.,

Declaration: I certify under the penalty of false statement that the tangible personal property described in this refund application

has been, or will be, shipped outside Connecticut by common or contract carrier, to be used or consumed solely outside the

state thereafter, and that no other claim for refund or credit has been filed with the Commissioner of Revenue Services for this

tangible personal property. (The penalty for false statement is imprisonment not to exceed one year or a fine not to exceed two

thousand dollars, or both.)

Print Name of Taxpayer

Date

Sign

Here

Authorized Signature

Title

1

1 2

2