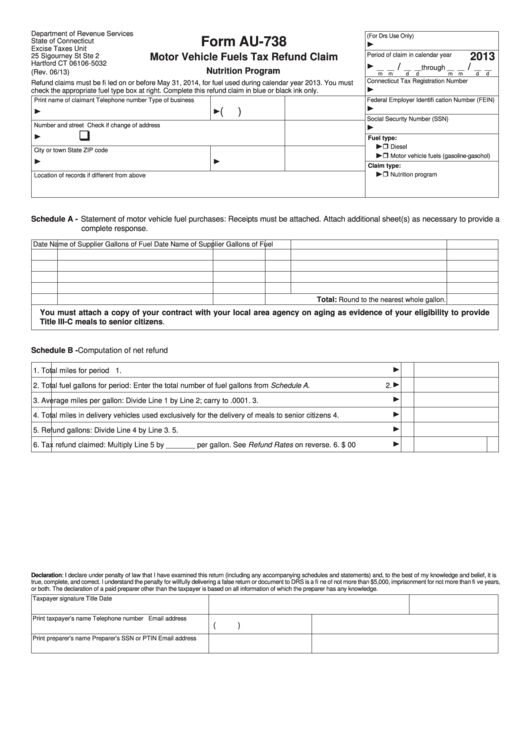

Department of Revenue Services

(For Drs Use Only)

Form AU-738

State of Connecticut

Excise Taxes Unit

Period of claim in calendar year

2013

Motor Vehicle Fuels Tax Refund Claim

25 Sigourney St Ste 2

Hartford CT 06106-5032

/

/

__ __

__ __ through __ __

__ __

Nutrition Program

(Rev. 06/13)

m

m

d

d

m

m

d

d

Connecticut Tax Registration Number

Refund claims must be fi led on or before May 31, 2014, for fuel used during calendar year 2013. You must

check the appropriate fuel type box at right. Complete this refund claim in blue or black ink only.

Federal Employer Identifi cation Number (FEIN)

Print name of claimant

Telephone number

Type of business

(

)

Social Security Number (SSN)

Number and street

Check if change of address

Fuel type:

Diesel

City or town

State

ZIP code

Motor vehicle fuels (gasoline-gasohol)

Claim type:

Nutrition program

Location of records if different from above

Schedule A - Statement of motor vehicle fuel purchases: Receipts must be attached. Attach additional sheet(s) as necessary to provide a

complete response.

Date

Name of Supplier

Gallons of Fuel

Date

Name of Supplier

Gallons of Fuel

Total:

Round to the nearest whole gallon.

You must attach a copy of your contract with your local area agency on aging as evidence of your eligibility to provide

Title III-C meals to senior citizens.

Schedule B - Computation of net refund

1.

Total miles for period

1.

2.

Total fuel gallons for period: Enter the total number of fuel gallons from Schedule A.

2.

3.

Average miles per gallon: Divide Line 1 by Line 2; carry to .0001.

3.

4.

Total miles in delivery vehicles used exclusively for the delivery of meals to senior citizens

4.

5.

Refund gallons: Divide Line 4 by Line 3.

5.

6.

Tax refund claimed: Multiply Line 5 by _______ per gallon. See Refund Rates on reverse.

6.

$

00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is

true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne of not more than $5,000, imprisonment for not more than fi ve years,

or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer signature

Title

Date

Print taxpayer’s name

Telephone number

Email address

(

)

Print preparer’s name

Preparer’s SSN or PTIN

Email address

1

1 2

2