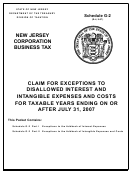

Form 312-A

(7-08, R-3)

INSTRUCTIONS

This form must be completed by any taxpayer claiming an effluent equipment tax credit on Form CBT-100, Form CBT-100S or Form

BFC-1. A completed Form 312 must be attached to the return to validate the claim.

PART I

QUALIFICATIONS

In order to be eligible for the tax credit, the answer to all questions in Part I must be “YES”. If the answer to any of the questions is

“NO”, the taxpayer is NOT entitled to the Effluent Equipment Tax Credit.

Taxpayers that have received the determination of environmentally beneficial operation from the Commissioner of the Department of

Environmental Protection must attach a copy of each determination along with Form 312 to the tax return. Also, taxpayers must include

an affidavit stating that the treatment equipment or conveyance equipment is or will be used exclusively in New Jersey.

NOTE: No amount of cost included in the calculation of this tax credit shall be included in the costs for calculation of any other credit

against the tax imposed pursuant to section 5 of P.L. 1945, c.162 (N.J.S.A. 54:10A-5).

PART II

EFFLUENT TREATMENT AND CONVEYANCE EQUIPMENT

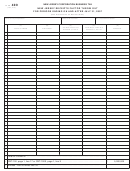

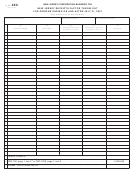

Complete the information requested in each of the columns (A) through (I) for each piece of equipment. If additional space is needed,

attach a rider in like format containing the information required in columns (A) through (I).

The cost amount to be reported in Column (C) is the invoice cost of the equipment.

Column (D) must reflect the total of the amount of any loan from the Department of Environmental Protection made pursuant to section

5 of P.L. 1981, c. 278 as amended (N.J.S.A. 13:1E-96) plus the amount of any Sales and Use Tax paid pursuant to P.L. 1966, c.30 as

amended (N.J.S.A. 54:32B-1 et seq.).

Enter in Column (G) the number of months that the equipment was used in New Jersey during the period covered by the return.

The prorated credit amount, reported in Column (H), is computed by multiplying Column (F) by Column (G) and dividing the result by

12.

Enter the totals of the amounts reported in Columns (H) and (I) in the space provided.

PART III

CALCULATION OF THE EFFLUENT EQUIPMENT TAX CREDIT

a) The total and allowable Effluent Equipment Tax Credit for the current year is calculated in Part III. The amount of this credit in

addition to the amount of any other tax credits taken is limited to 50% of the taxpayer’s total tax liability and cannot exceed an

amount which would reduce the total tax liability below the statutory minimum.

b) The minimum tax is assessed based on the New Jersey Gross Receipts as follows:

New Jersey Gross Receipts

Minimum Tax

Less than $100,000

$500

$100,000 or more but less than $250,000

$750

$250,000 or more but less than $500,000

$1,000

$500,000 or more but less than $1,000,000

$1,500

$1,000,000 or more

$2,000

provided however that for a taxpayer that is a member of an affiliated or controlled group which has a total payroll of $5,000,000

or more for the return period, the minimum tax shall be $2,000. Tax periods of less than 12 months are subject to the higher

minimum tax if the prorated total payroll exceeds $416,667 per month.

c) The priorities set forth in this Corporation Business Tax form follow Regulation N.J.A.C. 18:7-3.17.

UNUSED TAX CREDITS

Unused tax credits may be claimed in subsequent tax years subject to the limitations set forth on this form.

1

1 2

2 3

3