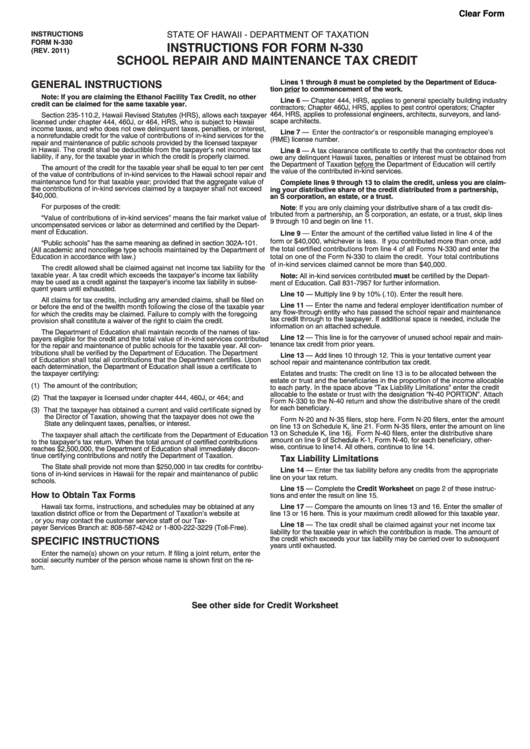

Instructions For Form N-330 - School Repair And Maintenance Tax Credit

ADVERTISEMENT

Clear Form

INSTRUCTIONS

STATE OF HAWAII - DEPARTMENT OF TAXATION

FORM N-330

INSTRUCTIONS FOR FORM N-330

(REV. 2011)

SCHOOL REPAIR AND MAINTENANCE TAX CREDIT

GENERAL INSTRUCTIONS

Lines 1 through 8 must be completed by the Department of Educa-

tion prior to commencement of the work.

Note: If you are claiming the Ethanol Facility Tax Credit, no other

Line 6 — Chapter 444, HRS, applies to general specialty building industry

credit can be claimed for the same taxable year.

contractors; Chapter 460J, HRS, applies to pest control operators; Chapter

464, HRS, applies to professional engineers, architects, surveyors, and land-

Section 235-110.2, Hawaii Revised Statutes (HRS), allows each taxpayer

scape architects.

licensed under chapter 444, 460J, or 464, HRS, who is subject to Hawaii

income taxes, and who does not owe delinquent taxes, penalties, or interest,

Line 7 — Enter the contractor’s or responsible managing employee’s

a nonrefundable credit for the value of contributions of in-kind services for the

(RME) license number.

repair and maintenance of public schools provided by the licensed taxpayer

in Hawaii. The credit shall be deductible from the taxpayer’s net income tax

Line 8 — A tax clearance certificate to certify that the contractor does not

liability, if any, for the taxable year in which the credit is properly claimed.

owe any delinquent Hawaii taxes, penalties or interest must be obtained from

the Department of Taxation before the Department of Education will certify

The amount of the credit for the taxable year shall be equal to ten per cent

the value of the contributed in-kind services.

of the value of contributions of in-kind services to the Hawaii school repair and

maintenance fund for that taxable year; provided that the aggregate value of

Complete lines 9 through 13 to claim the credit, unless you are claim-

the contributions of in-kind services claimed by a taxpayer shall not exceed

ing your distributive share of the credit distributed from a partnership,

$40,000.

an S corporation, an estate, or a trust.

For purposes of the credit:

Note: If you are only claiming your distributive share of a tax credit dis-

tributed from a partnership, an S corporation, an estate, or a trust, skip lines

“Value of contributions of in-kind services” means the fair market value of

9 through 10 and begin on line 11.

uncompensated services or labor as determined and certified by the Depart-

ment of Education.

Line 9 — Enter the amount of the certified value listed in line 4 of the

form or $40,000, whichever is less. If you contributed more than once, add

“Public schools” has the same meaning as defined in section 302A-101.

the total certified contributions from line 4 of all Forms N-330 and enter the

(All academic and noncollege type schools maintained by the Department of

Education in accordance with law.)

total on one of the Form N-330 to claim the credit. Your total contributions

of in-kind services claimed cannot be more than $40,000.

The credit allowed shall be claimed against net income tax liability for the

taxable year. A tax credit which exceeds the taxpayer’s income tax liability

Note: All in-kind services contributed must be certified by the Depart-

may be used as a credit against the taxpayer’s income tax liability in subse-

ment of Education. Call 831-7957 for further information.

quent years until exhausted.

Line 10 — Multiply line 9 by 10% (.10). Enter the result here.

All claims for tax credits, including any amended claims, shall be filed on

Line 11 — Enter the name and federal employer identification number of

or before the end of the twelfth month following the close of the taxable year

any flow-through entity who has passed the school repair and maintenance

for which the credits may be claimed. Failure to comply with the foregoing

tax credit through to the taxpayer. If additional space is needed, include the

provision shall constitute a waiver of the right to claim the credit.

information on an attached schedule.

The Department of Education shall maintain records of the names of tax-

Line 12 — This line is for the carryover of unused school repair and main-

payers eligible for the credit and the total value of in-kind services contributed

tenance tax credit from prior years.

for the repair and maintenance of public schools for the taxable year. All con-

tributions shall be verified by the Department of Education. The Department

Line 13 — Add lines 10 through 12. This is your tentative current year

of Education shall total all contributions that the Department certifies. Upon

school repair and maintenance contribution tax credit.

each determination, the Department of Education shall issue a certificate to

the taxpayer certifying:

Estates and trusts: The credit on line 13 is to be allocated between the

estate or trust and the beneficiaries in the proportion of the income allocable

(1) The amount of the contribution;

to each party. In the space above “Tax Liability Limitations” enter the credit

allocable to the estate or trust with the designation “N-40 PORTION”. Attach

(2) That the taxpayer is licensed under chapter 444, 460J, or 464; and

Form N-330 to the N-40 return and show the distributive share of the credit

for each beneficiary.

(3) That the taxpayer has obtained a current and valid certificate signed by

the Director of Taxation, showing that the taxpayer does not owe the

Form N-20 and N-35 filers, stop here. Form N-20 filers, enter the amount

State any delinquent taxes, penalties, or interest.

on line 13 on Schedule K, line 21. Form N-35 filers, enter the amount on line

13 on Schedule K, line 16j. Form N-40 filers, enter the distributive share

The taxpayer shall attach the certificate from the Department of Education

amount on line 9 of Schedule K-1, Form N-40, for each beneficiary, other-

to the taxpayer’s tax return. When the total amount of certified contributions

wise, continue to line14. All others, continue to line 14.

reaches $2,500,000, the Department of Education shall immediately discon-

tinue certifying contributions and notify the Department of Taxation.

Tax Liability Limitations

The State shall provide not more than $250,000 in tax credits for contribu-

Line 14 — Enter the tax liability before any credits from the appropriate

tions of in-kind services in Hawaii for the repair and maintenance of public

line on your tax return.

schools.

Line 15 — Complete the Credit Worksheet on page 2 of these instruc-

How to Obtain Tax Forms

tions and enter the result on line 15.

Line 17 — Compare the amounts on lines 13 and 16. Enter the smaller of

Hawaii tax forms, instructions, and schedules may be obtained at any

taxation district office or from the Department of Taxation’s website at www.

line 13 or 16 here. This is your maximum credit allowed for this taxable year.

hawaii.gov/tax, or you may contact the customer service staff of our Tax-

Line 18 — The tax credit shall be claimed against your net income tax

payer Services Branch at: 808-587-4242 or 1-800-222-3229 (Toll-Free).

liability for the taxable year in which the contribution is made. The amount of

SPECIFIC INSTRUCTIONS

the credit which exceeds your tax liability may be carried over to subsequent

years until exhausted.

Enter the name(s) shown on your return. If filing a joint return, enter the

social security number of the person whose name is shown first on the re-

turn.

See other side for Credit Worksheet

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2