Clear Form

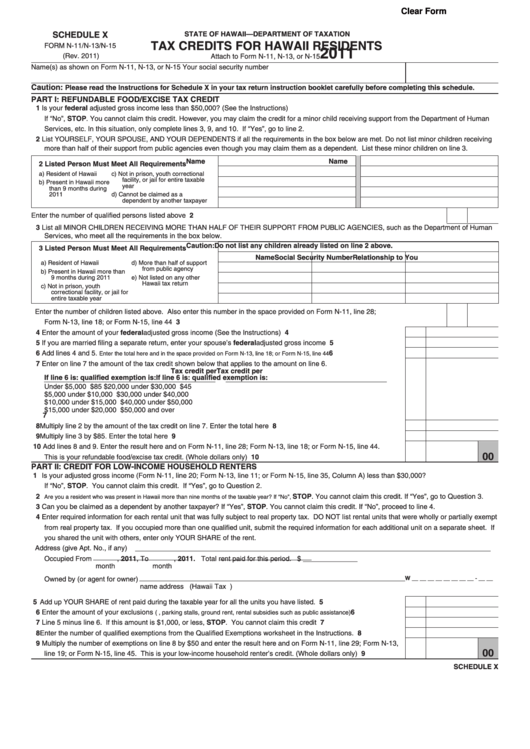

SCHEDULE X

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX CREDITS FOR HAWAII RESIDENTS

FORM N-11/N-13/N-15

2011

(Rev. 2011)

Attach to Form N-11, N-13, or N-15

Name(s) as shown on Form N-11, N-13, or N-15

Your social security number

Caution:

Please read the Instructions for Schedule X in your tax return instruction booklet carefully before completing this schedule.

PART I: REFUNDABLE FOOD/EXCISE TAX CREDIT

1 Is your federal adjusted gross income less than $50,000? (See the Instructions)

If “No”, STOP. You cannot claim this credit. However, you may claim the credit for a minor child receiving support from the Department of Human

Services, etc. In this situation, only complete lines 3, 9, and 10. If “Yes”, go to line 2.

2 List YOURSELF, YOUR SPOUSE, AND YOUR DEPENDENTS if all the requirements in the box below are met. Do not list minor children receiving

more than half of their support from public agencies even though you may claim them as a dependent. List these minor children on line 3.

Name

Name

2 Listed Person Must Meet All Requirements

a) Resident of Hawaii

c) Not in prison, youth correctional

facility, or jail for entire taxable

b) Present in Hawaii more

year

than 9 months during

2011

d) Cannot be claimed as a

dependent by another taxpayer

2

Enter the number of qualified persons listed above ................................................................................................................................

3 List all MINOR CHILDREN RECEIVING MORE THAN HALF OF THEIR SUPPORT FROM PUBLIC AGENCIES, such as the Department of Human

Services, who meet all the requirements in the box below.

Caution: Do not list any children already listed on line 2 above.

3 Listed Person Must Meet All Requirements

Name

Social Security Number

Relationship to You

a) Resident of Hawaii

d) More than half of support

from public agency

b) Present in Hawaii more than

9 months during 2011

e) Not listed on any other

Hawaii tax return

c) Not in prison, youth

correctional facility, or jail for

entire taxable year

Enter the number of children listed above. Also enter this number in the space provided on Form N-11, line 28;

3

Form N-13, line 18; or Form N-15, line 44 ..............................................................................................................................................

4 Enter the amount of your federal adjusted gross income (See the Instructions) ........................................................

4

5 If you are married filing a separate return, enter your spouse’s federal adjusted gross income .................................

5

6 Add lines 4 and 5. Enter the total here and in the space provided on Form N-13, line 18; or Form N-15, line 44 .................................

6

7 Enter on line 7 the amount of the tax credit shown below that applies to the amount on line 6.

Tax credit per

Tax credit per

If line 6 is:

qualified exemption is:

If line 6 is:

qualified exemption is:

Under $5,000 .............................................................$85

$20,000 under $30,000 ........................................$45

$5,000 under $10,000 .................................................75

$30,000 under $40,000 ..........................................35

$10,000 under $15,000 ...............................................65

$40,000 under $50,000 ..........................................25

$15,000 under $20,000 ...............................................55

$50,000 and over .....................................................0

7

8 Multiply line 2 by the amount of the tax credit on line 7. Enter the total here ...............................................................

8

9 Multiply line 3 by $85. Enter the total here ...................................................................................................................

9

10 Add lines 8 and 9. Enter the result here and on Form N-11, line 28; Form N-13, line 18; or Form N-15, line 44.

00

10

This is your refundable food/excise tax credit. (Whole dollars only) ............................................................................

PART II: CREDIT FOR LOW-INCOME HOUSEHOLD RENTERS

1 Is your adjusted gross income (Form N-11, line 20; Form N-13, line 11; or Form N-15, line 35, Column A) less than $30,000?

If “No”, STOP. You cannot claim this credit. If “Yes”, go to Question 2.

2 Are you a resident who was present in Hawaii more than nine months of the taxable year? If “No”, STOP. You cannot claim this credit. If “Yes”, go to Question 3.

3 Can you be claimed as a dependent by another taxpayer? If “Yes”, STOP. You cannot claim this credit. If “No”, proceed to line 4.

4 Enter required information for each rental unit that was fully subject to real property tax. DO NOT list rental units that were wholly or partially exempt

from real property tax. If you occupied more than one qualified unit, submit the required information for each additional unit on a separate sheet. If

you shared the unit with others, enter only YOUR SHARE of the rent.

Address (give Apt. No., if any)

, 2011, To

, 2011. Total rent paid for this period. $ ______________

Occupied From

month

month

W __ __ __ __ __ __ __ __ - __ __

Owned by (or agent for owner)

name

address

(Hawaii Tax I.D. Number)

5 Add up YOUR SHARE of rent paid during the taxable year for all the units you have listed. .......................................

5

6 Enter the amount of your exclusions

6

......

(e.g. utilities, parking stalls, ground rent, rental subsidies such as public assistance)

7 Line 5 minus line 6. If this amount is $1,000, or less, STOP. You cannot claim this credit .........................................

7

8 Enter the number of qualified exemptions from the Qualified Exemptions worksheet in the Instructions. ...................

8

9 Multiply the number of exemptions on line 8 by $50 and enter the result here and on Form N-11, line 29; Form N-13,

00

9

line 19; or Form N-15, line 45. This is your low-income household renter’s credit. (Whole dollars only) .....................

SCHEDULE X

1

1 2

2