Form Ct-1065/ct-1120si - Supplemental Attachment

ADVERTISEMENT

Department of Revenue Services

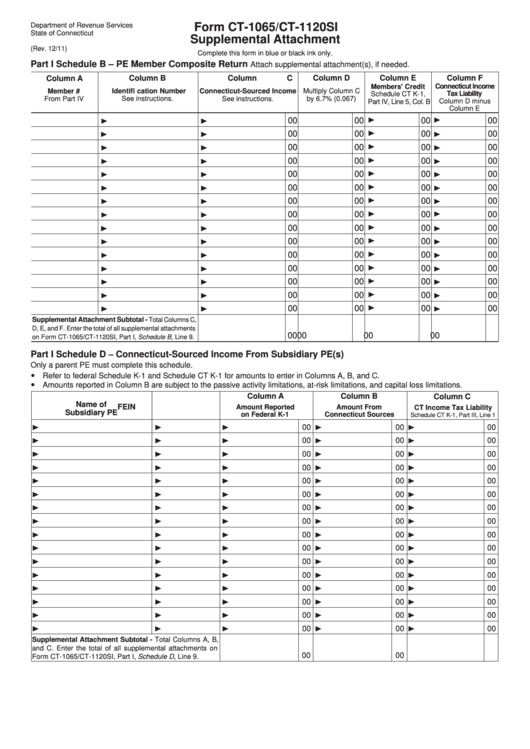

Form CT-1065/CT-1120SI

State of Connecticut

Supplemental Attachment

(Rev. 12/11)

Complete this form in blue or black ink only.

Part I Schedule B – PE Member Composite Return

Attach supplemental attachment(s), if needed.

Column B

Column C

Column D

Column E

Column F

Column A

Connecticut Income

Members' Credit

Identifi cation Number

Connecticut-Sourced Income

Multiply Column C

Member #

Tax Liability

Schedule CT K-1,

From Part IV

See instructions.

See instructions.

by 6.7% (0.067)

Column D minus

Part IV, Line 5, Col. B

Column E

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Supplemental Attachment Subtotal -

Total Columns C,

D, E, and F. Enter the total of all supplemental attachments

00

00

00

00

on Form CT-1065/CT-1120SI, Part I, Schedule B, Line 9.

Part I Schedule D – Connecticut-Sourced Income From Subsidiary PE(s)

Only a parent PE must complete this schedule.

Refer to federal Schedule K-1 and Schedule CT K-1 for amounts to enter in Columns A, B, and C.

Amounts reported in Column B are subject to the passive activity limitations, at-risk limitations, and capital loss limitations.

Column A

Column B

Column C

Name of

FEIN

Amount Reported

Amount From

CT Income Tax Liability

Subsidiary PE

on Federal K-1

Connecticut Sources

Schedule CT K-1, Part III, Line 1

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Supplemental Attachment Subtotal - Total Columns A, B,

and C. Enter the total of all supplemental attachments on

00

00

00

Form CT-1065/CT-1120SI, Part I, Schedule D, Line 9.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3