Form Tpg-211 - Withholding Calculation Rules - 2011

ADVERTISEMENT

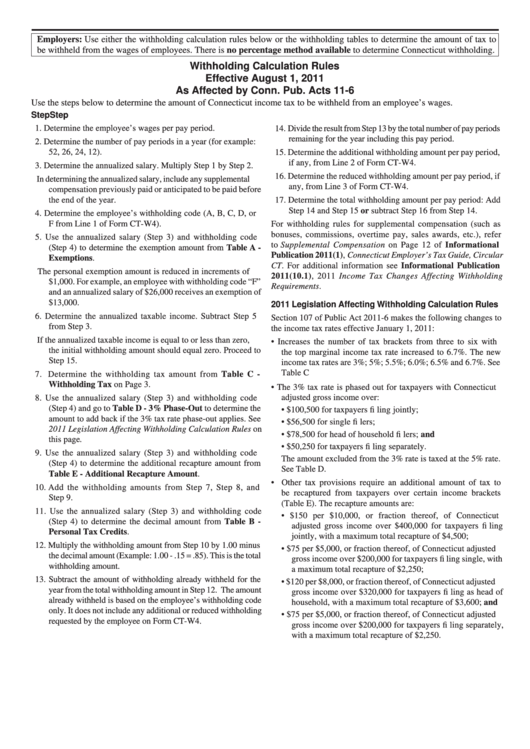

Employers: Use either the withholding calculation rules below or the withholding tables to determine the amount of tax to

be withheld from the wages of employees. There is no percentage method available to determine Connecticut withholding.

Withholding Calculation Rules

Effective August 1, 2011

As Affected by Conn. Pub. Acts 11-6

Use the steps below to determine the amount of Connecticut income tax to be withheld from an employee’s wages.

Step

Step

1. Determine the employee’s wages per pay period.

14. Divide the result from Step 13 by the total number of pay periods

remaining for the year including this pay period.

2. Determine the number of pay periods in a year (for example:

52, 26, 24, 12).

15. Determine the additional withholding amount per pay period,

if any, from Line 2 of Form CT-W4.

3. Determine the annualized salary. Multiply Step 1 by Step 2.

16. Determine the reduced withholding amount per pay period, if

In determining the annualized salary, include any supplemental

any, from Line 3 of Form CT-W4.

compensation previously paid or anticipated to be paid before

the end of the year.

17. Determine the total withholding amount per pay period: Add

Step 14 and Step 15 or subtract Step 16 from Step 14.

4. Determine the employee’s withholding code (A, B, C, D, or

F from Line 1 of Form CT-W4).

For withholding rules for supplemental compensation (such as

bonuses, commissions, overtime pay, sales awards, etc.), refer

5. Use the annualized salary (Step 3) and withholding code

to Supplemental Compensation on Page 12 of Informational

(Step 4) to determine the exemption amount from Table A -

Publication 2011(1), Connecticut Employer’s Tax Guide, Circular

Exemptions.

CT. For additional information see Informational Publication

The personal exemption amount is reduced in increments of

2011(10.1), 2011 Income Tax Changes Affecting Withholding

$1,000. For example, an employee with withholding code “F”

Requirements.

and an annualized salary of $26,000 receives an exemption of

$13,000.

2011 Legislation Affecting Withholding Calculation Rules

6. Determine the annualized taxable income. Subtract Step 5

Section 107 of Public Act 2011-6 makes the following changes to

from Step 3.

the income tax rates effective January 1, 2011:

If the annualized taxable income is equal to or less than zero,

• Increases the number of tax brackets from three to six with

the initial withholding amount should equal zero. Proceed to

the top marginal income tax rate increased to 6.7%. The new

Step 15.

income tax rates are 3%; 5%; 5.5%; 6.0%; 6.5% and 6.7%. See

Table C

7. Determine the withholding tax amount from Table C -

Withholding Tax on Page 3.

• The 3% tax rate is phased out for taxpayers with Connecticut

adjusted gross income over:

8. Use the annualized salary (Step 3) and withholding code

(Step 4) and go to Table D - 3% Phase-Out to determine the

• $100,500 for taxpayers fi ling jointly;

amount to add back if the 3% tax rate phase-out applies. See

• $56,500 for single fi lers;

2011 Legislation Affecting Withholding Calculation Rules on

• $78,500 for head of household fi lers; and

this page.

• $50,250 for taxpayers fi ling separately.

9. Use the annualized salary (Step 3) and withholding code

The amount excluded from the 3% rate is taxed at the 5% rate.

(Step 4) to determine the additional recapture amount from

See Table D.

Table E - Additional Recapture Amount.

• Other tax provisions require an additional amount of tax to

10. Add the withholding amounts from Step 7, Step 8, and

be recaptured from taxpayers over certain income brackets

Step 9.

(Table E). The recapture amounts are:

11. Use the annualized salary (Step 3) and withholding code

• $150 per $10,000, or fraction thereof, of Connecticut

(Step 4) to determine the decimal amount from Table B -

adjusted gross income over $400,000 for taxpayers fi ling

Personal Tax Credits.

jointly, with a maximum total recapture of $4,500;

12. Multiply the withholding amount from Step 10 by 1.00 minus

• $75 per $5,000, or fraction thereof, of Connecticut adjusted

the decimal amount (Example: 1.00 - .15 = .85). This is the total

gross income over $200,000 for taxpayers fi ling single, with

withholding amount.

a maximum total recapture of $2,250;

13. Subtract the amount of withholding already withheld for the

• $120 per $8,000, or fraction thereof, of Connecticut adjusted

year from the total withholding amount in Step 12. The amount

gross income over $320,000 for taxpayers fi ling as head of

already withheld is based on the employee’s withholding code

household, with a maximum total recapture of $3,600; and

only. It does not include any additional or reduced withholding

• $75 per $5,000, or fraction thereof, of Connecticut adjusted

requested by the employee on Form CT-W4.

gross income over $200,000 for taxpayers fi ling separately,

with a maximum total recapture of $2,250.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4