Reset

Print

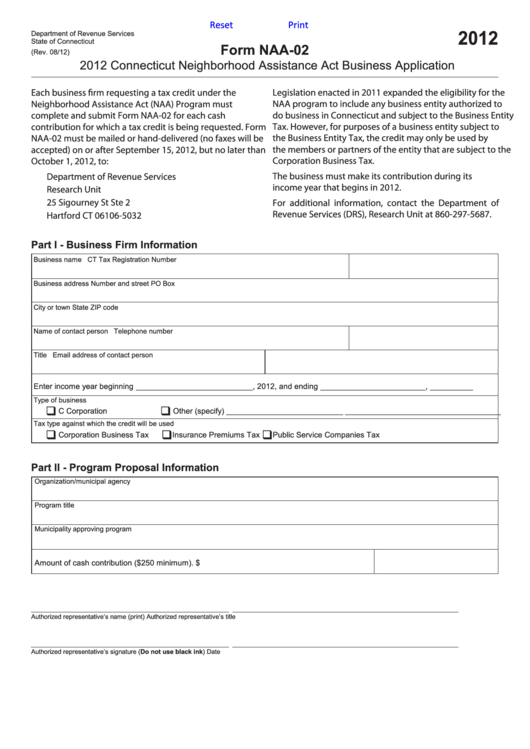

2012

Department of Revenue Services

State of Connecticut

Form NAA-02

(Rev. 08/12)

2012 Connecticut Neighborhood Assistance Act Business Application

Each business firm requesting a tax credit under the

Legislation enacted in 2011 expanded the eligibility for the

Neighborhood Assistance Act (NAA) Program must

NAA program to include any business entity authorized to

do business in Connecticut and subject to the Business Entity

complete and submit Form NAA-02 for each cash

Tax. However, for purposes of a business entity subject to

contribution for which a tax credit is being requested. Form

the Business Entity Tax, the credit may only be used by

NAA-02 must be mailed or hand-delivered (no faxes will be

accepted) on or after September 15, 2012, but no later than

the members or partners of the entity that are subject to the

October 1, 2012, to:

Corporation Business Tax.

Department of Revenue Services

The business must make its contribution during its

income year that begins in 2012.

Research Unit

25 Sigourney St Ste 2

For additional information, contact the Department of

Revenue Services (DRS), Research Unit at 860-297-5687.

Hartford CT 06106-5032

Part I - Business Firm Information

Business name

CT Tax Registration Number

Business address

Number and street

PO Box

City or town

State

ZIP code

Name of contact person

Telephone number

Title

Email address of contact person

Enter income year beginning

, 2012, and ending

,

______________________________

___________________________

___________

Type of business

C Corporation

Other (specify)

______________________________ ________________________________________

Tax type against which the credit will be used

Corporation Business Tax

Insurance Premiums Tax

Public Service Companies Tax

Part II - Program Proposal Information

Organization/municipal agency

Program title

Municipality approving program

Amount of cash contribution ($250 minimum).

$

________________________________________________________

________________________________________________________________

Authorized representative’s name (print)

Authorized representative’s title

________________________________________________________

________________________________________________________________

Authorized representative’s signature (Do not use black ink)

Date

1

1