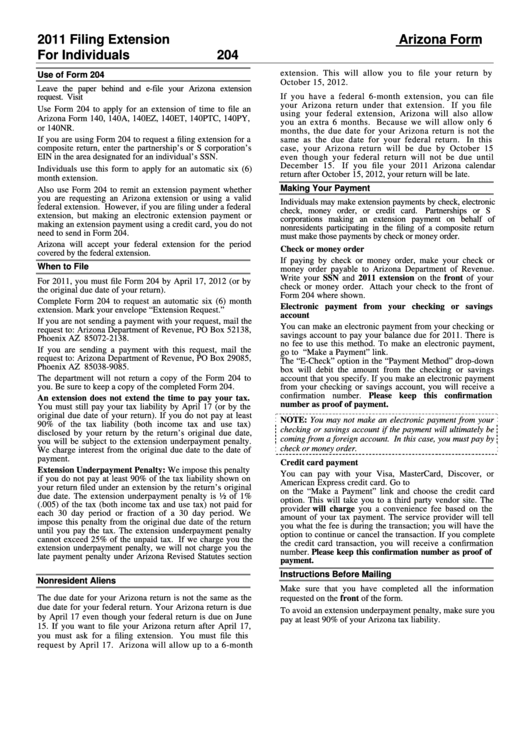

Instructions For Arizona Form 204 - Filing Extension Arizona Form For Individuals - 2011

ADVERTISEMENT

2011 Filing Extension

Arizona Form

For Individuals

204

extension. This will allow you to file your return by

Use of Form 204

October 15, 2012.

Leave the paper behind and e-file your Arizona extension

If you have a federal 6-month extension, you can file

request. Visit for e-file requirements.

your Arizona return under that extension. If you file

Use Form 204 to apply for an extension of time to file an

using your federal extension, Arizona will also allow

Arizona Form 140, 140A, 140EZ, 140ET, 140PTC, 140PY,

you an extra 6 months. Because we will allow only 6

or 140NR.

months, the due date for your Arizona return is not the

If you are using Form 204 to request a filing extension for a

same as the due date for your federal return. In this

composite return, enter the partnership’s or S corporation’s

case, your Arizona return will be due by October 15

EIN in the area designated for an individual’s SSN.

even though your federal return will not be due until

December 15.

If you file your 2011 Arizona calendar

Individuals use this form to apply for an automatic six (6)

return after October 15, 2012, your return will be late.

month extension.

Making Your Payment

Also use Form 204 to remit an extension payment whether

you are requesting an Arizona extension or using a valid

Individuals may make extension payments by check, electronic

federal extension. However, if you are filing under a federal

check, money order, or credit card.

Partnerships or S

extension, but making an electronic extension payment or

corporations making an extension payment on behalf of

making an extension payment using a credit card, you do not

nonresidents participating in the filing of a composite return

need to send in Form 204.

must make those payments by check or money order.

Arizona will accept your federal extension for the period

Check or money order

covered by the federal extension.

If paying by check or money order, make your check or

When to File

money order payable to Arizona Department of Revenue.

Write your SSN and 2011 extension on the front of your

For 2011, you must file Form 204 by April 17, 2012 (or by

check or money order. Attach your check to the front of

the original due date of your return).

Form 204 where shown.

Complete Form 204 to request an automatic six (6) month

Electronic payment from your checking or savings

extension. Mark your envelope “Extension Request.”

account

If you are not sending a payment with your request, mail the

You can make an electronic payment from your checking or

request to: Arizona Department of Revenue, PO Box 52138,

savings account to pay your balance due for 2011. There is

Phoenix AZ 85072-2138.

no fee to use this method. To make an electronic payment,

If you are sending a payment with this request, mail the

go to click on the “Make a Payment” link.

request to: Arizona Department of Revenue, PO Box 29085,

The “E-Check” option in the “Payment Method” drop-down

Phoenix AZ 85038-9085.

box will debit the amount from the checking or savings

The department will not return a copy of the Form 204 to

account that you specify. If you make an electronic payment

you. Be sure to keep a copy of the completed Form 204.

from your checking or savings account, you will receive a

confirmation number. Please keep this confirmation

An extension does not extend the time to pay your tax.

number as proof of payment.

You must still pay your tax liability by April 17 (or by the

original due date of your return). If you do not pay at least

NOTE: You may not make an electronic payment from your

90% of the tax liability (both income tax and use tax)

checking or savings account if the payment will ultimately be

disclosed by your return by the return’s original due date,

coming from a foreign account. In this case, you must pay by

you will be subject to the extension underpayment penalty.

check or money order.

We charge interest from the original due date to the date of

payment.

Credit card payment

Extension Underpayment Penalty: We impose this penalty

You can pay with your Visa, MasterCard, Discover, or

if you do not pay at least 90% of the tax liability shown on

American Express credit card. Go to click

your return filed under an extension by the return’s original

on the “Make a Payment” link and choose the credit card

due date. The extension underpayment penalty is ½ of 1%

option. This will take you to a third party vendor site. The

(.005) of the tax (both income tax and use tax) not paid for

provider will charge you a convenience fee based on the

each 30 day period or fraction of a 30 day period. We

amount of your tax payment. The service provider will tell

impose this penalty from the original due date of the return

you what the fee is during the transaction; you will have the

until you pay the tax. The extension underpayment penalty

option to continue or cancel the transaction. If you complete

cannot exceed 25% of the unpaid tax. If we charge you the

the credit card transaction, you will receive a confirmation

extension underpayment penalty, we will not charge you the

number. Please keep this confirmation number as proof of

late payment penalty under Arizona Revised Statutes section

payment.

42-1125.D.

Instructions Before Mailing

Nonresident Aliens

Make sure that you have completed all the information

The due date for your Arizona return is not the same as the

requested on the front of the form.

due date for your federal return. Your Arizona return is due

To avoid an extension underpayment penalty, make sure you

by April 17 even though your federal return is due on June

pay at least 90% of your Arizona tax liability.

15. If you want to file your Arizona return after April 17,

you must ask for a filing extension. You must file this

request by April 17. Arizona will allow up to a 6-month

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1