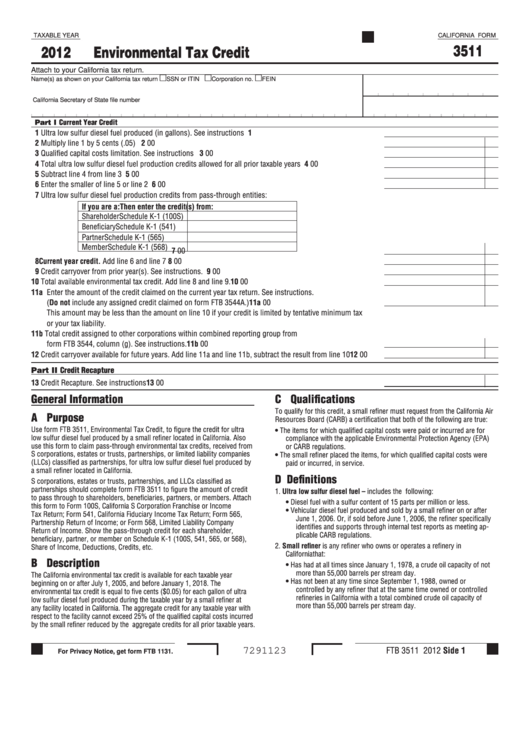

TAXABLE YEAR

CALIFORNIA FORM

3511

2012

Environmental Tax Credit

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

Corporation no.

FEIN

California Secretary of State file number

Part I Current Year Credit

1 Ultra low sulfur diesel fuel produced (in gallons). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Multiply line 1 by 5 cents (.05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Qualified capital costs limitation. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Total ultra low sulfur diesel fuel production credits allowed for all prior taxable years . . . . . . . . . . . . . . . . . . 4

00

5 Subtract line 4 from line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Enter the smaller of line 5 or line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 Ultra low sulfur diesel fuel production credits from pass-through entities:

If you are a:

Then enter the credit(s) from:

Shareholder

Schedule K-1 (100S)

Beneficiary

Schedule K-1 (541)

Partner

Schedule K-1 (565)

Member

Schedule K-1 (568)

7

00

. . . . . . . . . . . . . . . . . . . .

8 Current year credit. Add line 6 and line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 Credit carryover from prior year(s). See instructions.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 Total available environmental tax credit. Add line 8 and line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

00

11a Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544A.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11a

00

This amount may be less than the amount on line 10 if your credit is limited by tentative minimum tax

or your tax liability.

11b Total credit assigned to other corporations within combined reporting group from

form FTB 3544, column (g). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11b

00

12 Credit carryover available for future years. Add line 11a and line 11b, subtract the result from line 10 . . . . .12

00

Part II Credit Recapture

13 Credit Recapture. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

00

General Information

C Qualifications

To qualify for this credit, a small refiner must request from the California Air

A Purpose

Resources Board (CARB) a certification that both of the following are true:

Use form FTB 3511, Environmental Tax Credit, to figure the credit for ultra

• The items for which qualified capital costs were paid or incurred are for

low sulfur diesel fuel produced by a small refiner located in California. Also

compliance with the applicable Environmental Protection Agency (EPA)

use this form to claim pass-through environmental tax credits, received from

or CARB regulations.

S corporations, estates or trusts, partnerships, or limited liability companies

• The small refiner placed the items, for which qualified capital costs were

(LLCs) classified as partnerships, for ultra low sulfur diesel fuel produced by

paid or incurred, in service.

a small refiner located in California.

D Definitions

S corporations, estates or trusts, partnerships, and LLCs classified as

partnerships should complete form FTB 3511 to figure the amount of credit

1. Ultra low sulfur diesel fuel – includes the following:

to pass through to shareholders, beneficiaries, partners, or members. Attach

• Diesel fuel with a sulfur content of 15 parts per million or less.

this form to Form 100S, California S Corporation Franchise or Income

• Vehicular diesel fuel produced and sold by a small refiner on or after

Tax Return; Form 541, California Fiduciary Income Tax Return; Form 565,

June 1, 2006. Or, if sold before June 1, 2006, the refiner specifically

Partnership Return of Income; or Form 568, Limited Liability Company

identifies and supports through internal test reports as meeting ap-

Return of Income. Show the pass-through credit for each shareholder,

plicable CARB regulations.

beneficiary, partner, or member on Schedule K-1 (100S, 541, 565, or 568),

2. Small refiner is any refiner who owns or operates a refinery in

Share of Income, Deductions, Credits, etc.

California that:

B Description

• Has had at all times since January 1, 1978, a crude oil capacity of not

more than 55,000 barrels per stream day.

The California environmental tax credit is available for each taxable year

• Has not been at any time since September 1, 1988, owned or

beginning on or after July 1, 2005, and before January 1, 2018. The

controlled by any refiner that at the same time owned or controlled

environmental tax credit is equal to five cents ($0.05) for each gallon of ultra

refineries in California with a total combined crude oil capacity of

low sulfur diesel fuel produced during the taxable year by a small refiner at

more than 55,000 barrels per stream day.

any facility located in California. The aggregate credit for any taxable year with

respect to the facility cannot exceed 25% of the qualified capital costs incurred

by the small refiner reduced by the aggregate credits for all prior taxable years.

FTB 3511 2012 Side 1

7291123

For Privacy Notice, get form FTB 1131.

1

1