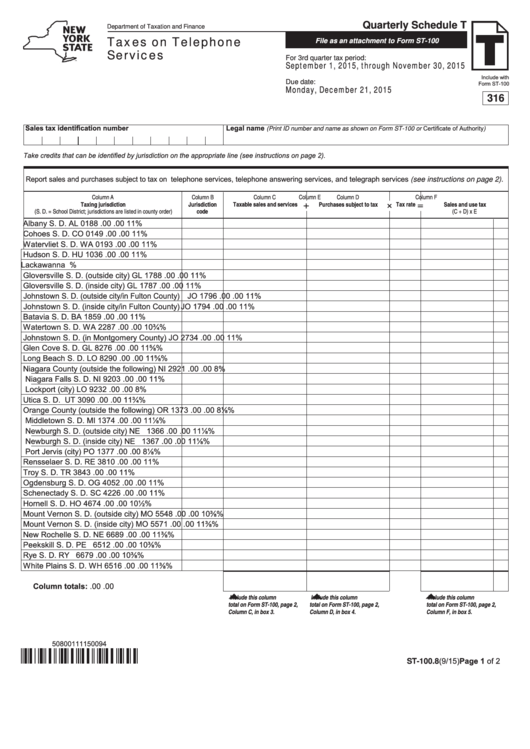

Quarterly Schedule T

Department of Taxation and Finance

Taxes on Telephone

File as an attachment to Form ST-100

Services

For 3rd quarter tax period:

September 1, 2015, through November 30, 2015

Include with

Due date:

Form ST-100

Monday, December 21, 2015

316

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-100 or Certificate of Authority)

Take credits that can be identified by jurisdiction on the appropriate line (see instructions on page 2).

Report sales and purchases subject to tax on telephone services, telephone answering services, and telegraph services (see instructions on page 2).

Column A

Column B

Column C

Column D

Column E

Column F

+

×

=

Taxing jurisdiction

Jurisdiction

Taxable sales and services

Purchases subject to tax

Tax rate

Sales and use tax

(S. D. = School District; jurisdictions are listed in county order)

code

(C + D) x E

Albany S. D.

AL 0188

.00

.00

11%

Cohoes S. D.

CO 0149

.00

.00

11%

Watervliet S. D.

WA 0193

.00

.00

11%

Hudson S. D.

HU 1036

.00

.00

11%

Lackawanna S.D.

LA 1456

.00

.00 11¾%

Gloversville S. D. (outside city)

GL 1788

.00

.00

11%

Gloversville S. D. (inside city)

GL 1787

.00

.00

11%

Johnstown S. D. (outside city/in Fulton County)

JO 1796

.00

.00

11%

Johnstown S. D. (inside city/in Fulton County)

JO 1794

.00

.00

11%

Batavia S. D.

BA 1859

.00

.00

11%

Watertown S. D.

WA 2287

.00

.00 10¾%

Johnstown S. D. (in Montgomery County)

JO 2734

.00

.00

11%

Glen Cove S. D.

GL 8276

.00

.00 11⅝%

Long Beach S. D.

LO 8290

.00

.00 11⅝%

Niagara County (outside the following)

NI 2921

.00

.00

8%

Niagara Falls S. D.

NI 9203

.00

.00

11%

Lockport (city)

LO 9232

.00

.00

8%

Utica S. D.

UT 3090

.00

.00 11¾%

Orange County (outside the following)

OR 1373

.00

.00

8⅛%

Middletown S. D.

MI 1374

.00

.00 11⅛%

Newburgh S. D. (outside city)

NE 1366

.00

.00 11⅛%

Newburgh S. D. (inside city)

NE 1367

.00

.00 11⅛%

Port Jervis (city)

PO 1377

.00

.00

8⅛%

Rensselaer S. D.

RE 3810

.00

.00

11%

Troy S. D.

TR 3843

.00

.00

11%

Ogdensburg S. D.

OG 4052

.00

.00

11%

Schenectady S. D.

SC 4226

.00

.00

11%

Hornell S. D.

HO 4674

.00

.00 10½%

Mount Vernon S. D. (outside city)

MO 5548

.00

.00 10⅜%

Mount Vernon S. D. (inside city)

MO 5571

.00

.00 11⅜%

New Rochelle S. D.

NE 6689

.00

.00 11⅜%

Peekskill S. D.

PE 6512

.00

.00 10⅜%

Rye S. D.

RY 6679

.00

.00 10⅜%

White Plains S. D.

WH 6516

.00

.00 11⅜%

Column totals:

.00

.00

Include this column

Include this column

Include this column

total on Form ST-100, page 2,

total on Form ST-100, page 2,

total on Form ST-100, page 2,

Column C, in box 3.

Column D, in box 4.

Column F, in box 5.

50800111150094

ST-100.8 (9/15) Page 1 of 2

1

1 2

2