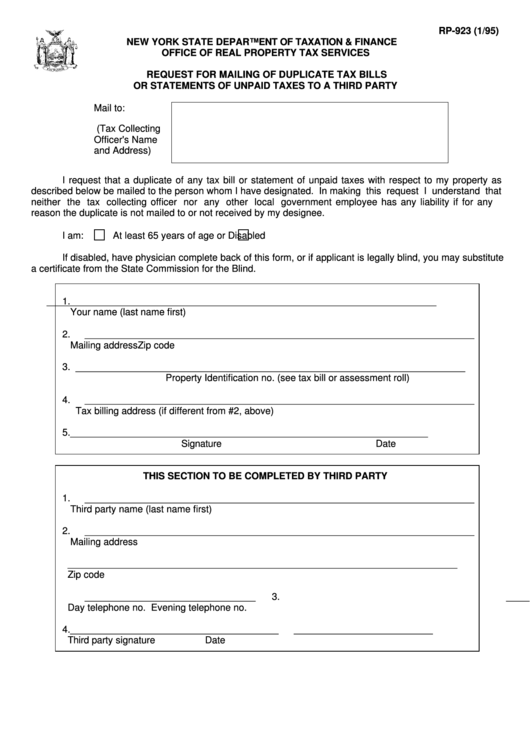

RP-923 (1/95)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

REQUEST FOR MAILING OF DUPLICATE TAX BILLS

OR STATEMENTS OF UNPAID TAXES TO A THIRD PARTY

Mail to:

(Tax Collecting

Officer's Name

and Address)

I request that a duplicate of any tax bill or statement of unpaid taxes with respect to my property as

described below be mailed to the person whom I have designated. In making this request I understand that

neither the tax collecting officer nor any other local government employee has any liability if for any

reason the duplicate is not mailed to or not received by my designee.

I am:

At least 65 years of age or

Disabled

If disabled, have physician complete back of this form, or if applicant is legally blind, you may substitute

a certificate from the State Commission for the Blind.

1.

_________________________________________________________________________

Your name (last name first)

2.

_________________________________________________________________________

Mailing address

Zip code

3.

_________________________________________________________________________

Property Identification no. (see tax bill or assessment roll)

4.

_________________________________________________________________________

Tax billing address (if different from #2, above)

5.

__________________________________________

_________________________

Signature

Date

THIS SECTION TO BE COMPLETED BY THIRD PARTY

1.

_________________________________________________________________________

Third party name (last name first)

2.

_________________________________________________________________________

Mailing address

_________________________________________________________________________

Zip code

3.

________________________________

________________________________

Day telephone no.

Evening telephone no.

4.

_______________________________________

__________________________

Third party signature

Date

1

1 2

2