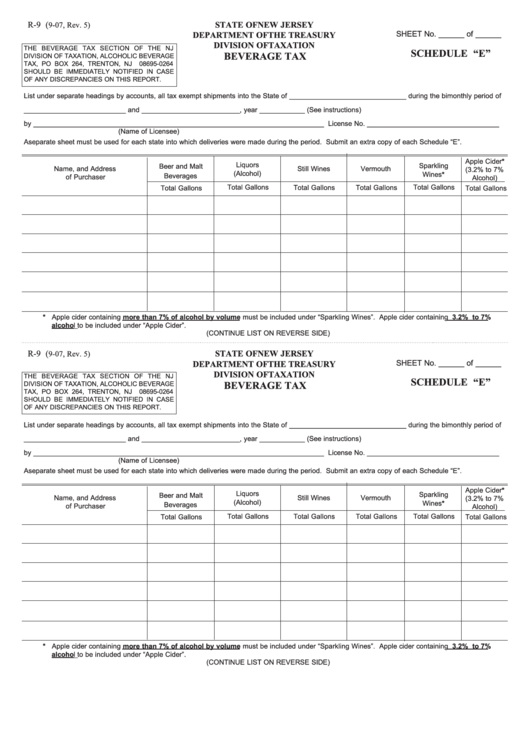

R-9 (

STATE OF NEW JERSEY

9-07, Rev. 5)

SHEET No. ______ of ______

DEPARTMENT OF THE TREASURY

DIVISION OF TAXATION

THE BEVERAGE TAX SECTION OF THE NJ

SCHEDULE “E”

BEVERAGE TAX

DIVISION OF TAXATION, ALCOHOLIC BEVERAGE

TAX, PO BOX 264, TRENTON, NJ

08695-0264

SHOULD BE IMMEDIATELY NOTIFIED IN CASE

OF ANY DISCREPANCIES ON THIS REPORT.

List under separate headings by accounts, all tax exempt shipments into the State of _______________________________ during the bimonthly period of

___________________________ and __________________________, year ____________ (See instructions)

by _____________________________________________________________________________ License No. ___________________________________

(Name of Licensee)

A separate sheet must be used for each state into which deliveries were made during the period. Submit an extra copy of each Schedule “E”.

Apple Cider*

Liquors

Sparkling

Beer and Malt

Name, and Address

Still Wines

Vermouth

(3.2% to 7%

(Alcohol)

Wines*

Beverages

of Purchaser

Alcohol)

Total Gallons

Total Gallons

Total Gallons

Total Gallons

Total Gallons

Total Gallons

* Apple cider containing more than 7% of alcohol by volume must be included under “Sparkling Wines”. Apple cider containing 3.2% to 7%

alcohol to be included under “Apple Cider”.

(CONTINUE LIST ON REVERSE SIDE)

R-9 (

9-07, Rev. 5)

STATE OF NEW JERSEY

SHEET No. ______ of ______

DEPARTMENT OF THE TREASURY

DIVISION OF TAXATION

THE BEVERAGE TAX SECTION OF THE NJ

SCHEDULE “E”

DIVISION OF TAXATION, ALCOHOLIC BEVERAGE

BEVERAGE TAX

TAX, PO BOX 264, TRENTON, NJ

08695-0264

SHOULD BE IMMEDIATELY NOTIFIED IN CASE

OF ANY DISCREPANCIES ON THIS REPORT.

List under separate headings by accounts, all tax exempt shipments into the State of _______________________________ during the bimonthly period of

___________________________ and __________________________, year ____________ (See instructions)

by _____________________________________________________________________________ License No. ___________________________________

(Name of Licensee)

A separate sheet must be used for each state into which deliveries were made during the period. Submit an extra copy of each Schedule “E”.

Apple Cider*

Liquors

Sparkling

Beer and Malt

Name, and Address

Still Wines

Vermouth

(3.2% to 7%

(Alcohol)

Wines*

Beverages

of Purchaser

Alcohol)

Total Gallons

Total Gallons

Total Gallons

Total Gallons

Total Gallons

Total Gallons

* Apple cider containing more than 7% of alcohol by volume must be included under “Sparkling Wines”. Apple cider containing 3.2% to 7%

alcohol to be included under “Apple Cider”.

(CONTINUE LIST ON REVERSE SIDE)

1

1