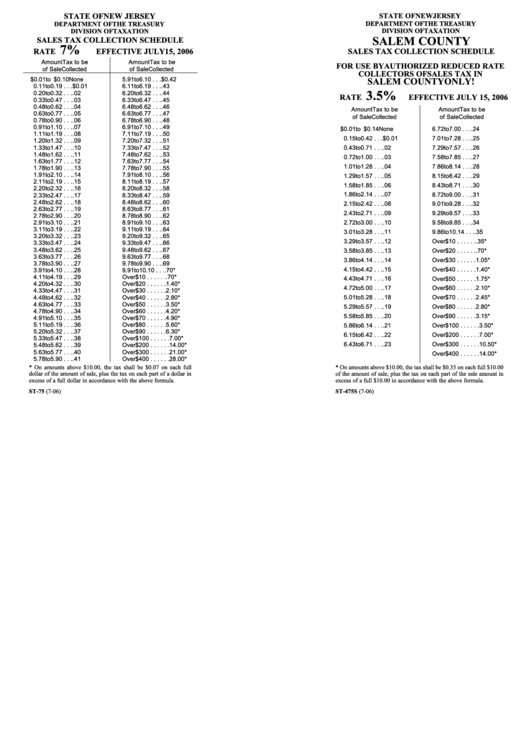

Form St-75 - Sales Tax Collection Schedule - Rate 7% - 2006, Form St-475s - Sales Tax Collection Schedule - Rate 3.5% - 2006

ADVERTISEMENT

STATE OF NEW JERSEY

STATE OF NEW JERSEY

DEPARTMENT OF THE TREASURY

DEPARTMENT OF THE TREASURY

DIVISION OF TAXATION

DIVISION OF TAXATION

SALEM COUNTY

SALES TAX COLLECTION SCHEDULE

7%

RATE

EFFECTIVE JULY 15, 2006

SALES TAX COLLECTION SCHEDULE

Amount

Tax to be

Amount

Tax to be

FOR USE BY AUTHORIZED REDUCED RATE

of Sale

Collected

of Sale

Collected

COLLECTORS OF SALES TAX IN

$0.01 to $0.10

None

5.91 to 6.10 . . . $0.42

SALEM COUNTY ONLY!

0.11 to 0.19 . . . $0.01

6.11 to 6.19 . . .

.43

3.5%

0.20 to 0.32 . . .

.02

6.20 to 6.32 . . .

.44

RATE

EFFECTIVE JULY 15, 2006

0.33 to 0.47 . . .

.03

6.33 to 6.47 . . .

.45

0.48 to 0.62 . . .

.04

6.48 to 6.62 . . .

.46

Amount

Tax to be

Amount

Tax to be

0.63 to 0.77 . . .

.05

6.63 to 6.77 . . .

.47

of Sale

Collected

of Sale

Collected

0.78 to 0.90 . . .

.06

6.78 to 6.90 . . .

.48

0.91 to 1.10 . . .

.07

6.91 to 7.10 . . .

.49

$0.01 to $0.14

None

6.72 to 7.00 . . .

.24

1.11 to 1.19 . . .

.08

7.11 to 7.19 . . .

.50

0.15 to 0.42 . . . $0.01

7.01 to 7.28 . . .

.25

1.20 to 1.32 . . .

.09

7.20 to 7.32 . . .

.51

1.33 to 1.47 . . .

.10

7.33 to 7.47 . . .

.52

0.43 to 0.71 . . .

.02

7.29 to 7.57 . . .

.26

1.48 to 1.62 . . .

.11

7.48 to 7.62 . . .

.53

0.72 to 1.00 . . .

.03

7.58 to 7.85 . . .

.27

1.63 to 1.77 . . .

.12

7.63 to 7.77 . . .

.54

1.01 to 1.28 . . .

.04

7.86 to 8.14 . . .

.28

1.78 to 1.90 . . .

.13

7.78 to 7.90 . . .

.55

1.91 to 2.10 . . .

.14

7.91 to 8.10 . . .

.56

1.29 to 1.57 . . .

.05

8.15 to 8.42 . . .

.29

2.11 to 2.19 . . .

.15

8.11 to 8.19 . . .

.57

1.58 to 1.85 . . .

.06

8.43 to 8.71 . . .

.30

2.20 to 2.32 . . .

.16

8.20 to 8.32 . . .

.58

1.86 to 2.14 . . .

.07

8.72 to 9.00 . . .

.31

2.33 to 2.47 . . .

.17

8.33 to 8.47 . . .

.59

2.48 to 2.62 . . .

.18

8.48 to 8.62 . . .

.60

2.15 to 2.42 . . .

.08

9.01 to 9.28 . . .

.32

2.63 to 2.77 . . .

.19

8.63 to 8.77 . . .

.61

2.43 to 2.71 . . .

.09

9.29 to 9.57 . . .

.33

2.78 to 2.90 . . .

.20

8.78 to 8.90 . . .

.62

2.91 to 3.10 . . .

.21

8.91 to 9.10 . . .

.63

2.72 to 3.00 . . .

.10

9.58 to 9.85 . . .

.34

3.11 to 3.19 . . .

.22

9.11 to 9.19 . . .

.64

3.01 to 3.28 . . .

.11

9.86 to 10.14 . . .

.35

3.20 to 3.32 . . .

.23

9.20 to 9.32 . . .

.65

3.29 to 3.57 . . .

.12

Over

$10 . . . . . .

.35*

3.33 to 3.47 . . .

.24

9.33 to 9.47 . . .

.66

3.48 to 3.62 . . .

.25

9.48 to 9.62 . . .

.67

3.58 to 3.85 . . .

.13

Over

$20 . . . . . .

.70*

3.63 to 3.77 . . .

.26

9.63 to 9.77 . . .

.68

3.86 to 4.14 . . .

.14

Over

$30 . . . . . . 1.05*

3.78 to 3.90 . . .

.27

9.78 to 9.90 . . .

.69

4.15 to 4.42 . . .

.15

Over

$40 . . . . . . 1.40*

3.91 to 4.10 . . .

.28

9.91 to 10.10 . . .

.70*

4.11 to 4.19 . . .

.29

Over

$10 . . . . . .

.70*

4.43 to 4.71 . . .

.16

Over

$50 . . . . . . 1.75*

4.20 to 4.32 . . .

.30

Over

$20 . . . . . . 1.40*

4.72 to 5.00 . . .

.17

Over

$60 . . . . . . 2.10*

4.33 to 4.47 . . .

.31

Over

$30 . . . . . . 2.10*

4.48 to 4.62 . . .

.32

Over

$40 . . . . . . 2.80*

5.01 to 5.28 . . .

.18

Over

$70 . . . . . . 2.45*

4.63 to 4.77 . . .

.33

Over

$50 . . . . . . 3.50*

5.29 to 5.57 . . .

.19

Over

$80 . . . . . . 2.80*

4.78 to 4.90 . . .

.34

Over

$60 . . . . . . 4.20*

5.58 to 5.85 . . .

.20

Over

$90 . . . . . . 3.15*

4.91 to 5.10 . . .

.35

Over

$70 . . . . . . 4.90*

5.11 to 5.19 . . .

.36

Over

$80 . . . . . . 5.60*

5.86 to 6.14 . . .

.21

Over $100 . . . . . . 3.50*

5.20 to 5.32 . . .

.37

Over

$90 . . . . . . 6.30*

6.15 to 6.42 . . .

.22

Over $200 . . . . . . 7.00*

5.33 to 5.47 . . .

.38

Over $100 . . . . . . 7.00*

6.43 to 6.71 . . .

.23

Over $300 . . . . . . 10.50*

5.48 to 5.62 . . .

.39

Over $200 . . . . . . 14.00*

5.63 to 5.77 . . .

.40

Over $300 . . . . . . 21.00*

Over $400 . . . . . . 14.00*

5.78 to 5.90 . . .

.41

Over $400 . . . . . . 28.00*

* On amounts above $10.00, the tax shall be $0.07 on each full

* On amounts above $10.00, the tax shall be $0.35 on each full $10.00

dollar of the amount of sale, plus the tax on each part of a dollar in

of the amount of sale, plus the tax on each part of the sale amount in

excess of a full dollar in accordance with the above formula.

excess of a full $10.00 in accordance with the above formula.

ST-75 (7-06)

ST-475S (7-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1