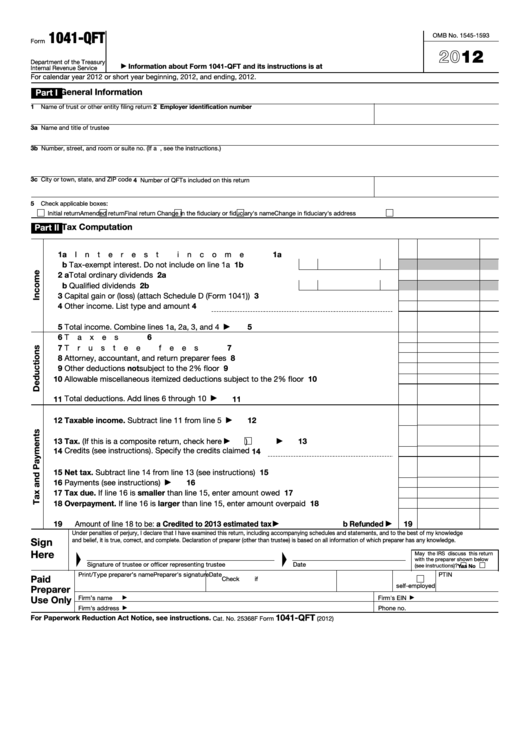

1041-QFT

OMB No. 1545-1593

Form

U.S. Income Tax Return for Qualified Funeral Trusts

2012

Department of the Treasury

Information about Form 1041-QFT and its instructions is at

▶

Internal Revenue Service

For calendar year 2012 or short year beginning

, 2012, and ending

, 2012.

General Information

Part I

1

Name of trust or other entity filing return

2 Employer identification number

3a Name and title of trustee

3b Number, street, and room or suite no. (If a P.O. box, see the instructions.)

3c City or town, state, and ZIP code

4 Number of QFTs included on this return

5

Check applicable boxes:

Initial return

Amended return

Final return

Change in the fiduciary or fiduciary's name

Change in fiduciary's address

Tax Computation

Part II

1a Interest income .

1a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Tax-exempt interest. Do not include on line 1a .

.

.

.

.

1b

2 a Total ordinary dividends .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2a

b Qualified dividends .

2b

.

.

.

.

.

.

.

.

.

.

.

.

.

3

3

Capital gain or (loss) (attach Schedule D (Form 1041))

.

.

.

.

.

.

.

.

.

.

.

.

4

Other income. List type and amount

4

5

5

Total income. Combine lines 1a, 2a, 3, and 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

6

Taxes

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Trustee fees .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

8

Attorney, accountant, and return preparer fees .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Other deductions not subject to the 2% floor .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

Allowable miscellaneous itemized deductions subject to the 2% floor .

.

.

.

.

.

.

10

Total deductions. Add lines 6 through 10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

11

▶

12

Taxable income. Subtract line 11 from line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

12

▶

13

Tax. (If this is a composite return, check here

)

.

.

.

.

.

.

.

.

.

.

.

13

▶

▶

Credits (see instructions). Specify the credits claimed

14

14

15

Net tax. Subtract line 14 from line 13 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

15

16

Payments (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

▶

17

Tax due. If line 16 is smaller than line 15, enter amount owed

17

.

.

.

.

.

.

.

.

.

18

Overpayment. If line 16 is larger than line 15, enter amount overpaid .

.

.

.

.

.

.

18

19

Amount of line 18 to be: a Credited to 2013 estimated tax

b Refunded

19

▶

▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

Sign

and belief, it is true, correct, and complete. Declaration of preparer (other than trustee) is based on all information of which preparer has any knowledge.

Here

May the IRS discuss this return

with the preparer shown below

Signature of trustee or officer representing trustee

Date

(see instructions)?

Yes

No

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Use Only

Firm’s name

Firm's EIN

▶

▶

Firm's address

Phone no.

▶

1041-QFT

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 25368F

Form

(2012)

1

1 2

2 3

3 4

4