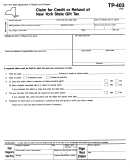

Form Tp-164.14 - Application For Refund Of New York State Motor Fuel Tax By An Omnibus Carrier Page 2

ADVERTISEMENT

TP-164.14 (11/06) (back)

Instructions

General information

its operations in the form of a vehicular trip record for each bus, listing

vehicular number, gallons of fuel consumed and the monthly total of

To qualify for a refund you must be one of the following:

gallons consumed. A carrier claiming a credit or refund under paragraph

(ii) must keep a daily record of its operations in the form of a vehicular

• Interstate Commerce Commission Certificated Operator

• Department of Transportation Certificated Operator

trip record for each bus, including the following information:

• District School Contractor

1. Vehicle number

• Carrier operating pursuant to a contract, franchise or consent with

2. Date of each trip

New York City or any agency thereof

3. Origin and destination of each trip

4. Points between which credit or refund is claimed

Omnibus carrier shall mean every person engaged in operating

5. Total miles traveled

an omnibus line subject to the supervision of the New York State

6. Credit or refund miles claimed

Commissioner of Transportation including every person operating

7. Gallons of fuel consumed

omnibuses used for the transportation of school children under a

8. Gallons credit or refund claimed

contract made pursuant to the provisions of the education law.

Items 5, 6, 7 and 8 must be totaled at the end of each month for each

An omnibus carrier who operates in local transit service pursuant to a

bus.

certificate of convenience and necessity issued by the Department of

Transportation or the Interstate Commerce Commission or pursuant to

A tax may not be refunded until it has been collected. This is made clear

a contract, franchise or consent of New York City or one of its agencies

by Tax Law subdivision 3 of section 289-c:

may claim a refund of New York State tax paid of $.08 per gallon on the

no such claims shall be paid unless the Department of Taxation and

gasoline consumed in this state by an omnibus engaged in local transit

Finance is satisfied that the amount of the tax for which the

service. No refund is allowable under this provision for charter or other

reimbursement is claimed has actually been collected by the state.

contract operations, that is, operations under a contract with any party

other than New York City.

The state does not collect until the month following that in which the tax

was paid by the purchaser. It follows that refunds for the month of March

An omnibus in local transit service is an omnibus carrying passengers

cannot be made until the department has received the tax due the

from one point in this state to another point in this state and

state from the distributor late in April, and similarly for the succeeding

which either

months.

(i) regularly picks up or discharges such passengers at their

convenience or at bus stops on the street or highway, as

The Tax Law was amended effective September 1, 2006, to exempt E85

distinguished from building or facilities used for bus terminals or

delivered to a filling station, CNG, and hydrogen from excise tax and

stations, or

petroleum business tax. For more information, see TSB-M-06(2), Excise

Tax and Petroleum Business Tax Exemptions for Certain Alternative

(ii) picks up and discharges passengers at bus terminals or stations, the

Fuels Beginning September 1, 2006.

distance between which is not more than seventy-five miles,

measured along the route traveled by the bus.

Claims for refund should include a complete calendar month. In

no case will a refund be made by the department in respect of

Any omnibus carrier that qualifies as being engaged in local transit

purchases made more than three years prior to the date of filing

service as defined in paragraph (i) above must keep a daily record of

the claim.

Sales invoices or monthly statements showing the name and address of dealer, name and address of claimant, date of purchase (month, day

and year), number of gallons purchased, and the fact that the tax was included in purchase price are required. After the claim has been paid, the

evidence of purchase will be returned provided a stamped addressed envelope with sufficient postage attached is forwarded to the office.

List in Schedule 1 and 2 below all purchases - bulk and over-the-road. (Invoices or monthly statements must be submitted.) Attach additional

sheets if necessary.

Schedule 1 - Bulk purchases

Schedule 2 - Over-the-road purchases

Date of purchase

Date of purchase

Total gallons

Total gallons

Purchased from

Purchased from

Month

Day

Year

purchased

Month

Day

Year

purchased

Total

..............................................

Total

.............................................

(enter here and on line B on the front page)

(enter here and on line C on the front page)

Claim for refund or reimbursement of tax paid on motor fuel should be based on the following records (including the original records) which must be

preserved for three years and be produced at any time for audit by the department.

(1) A record of all purchases of motor fuel by the claimant, and a record of the manner in which all motor fuel was used.

(2) Where a storage tank, drum, or other container is used, the claimant shall in addition keep a record of the quantity of motor fuel

put into such storage tank, drum or other container and also a record of all withdrawals therefrom for nontaxable or reimbursable uses.

Note: The disclosure of identifying number, including social security number, is required by section 287-c-3(c) of the tax law, such numbers are used for tax administration purposes and as necessary pursuant to

executive law section 49 and when the taxpayer gives written authorization to this department for another department, person, agency or entity to have access, limited or otherwise, to information contained in his

return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2