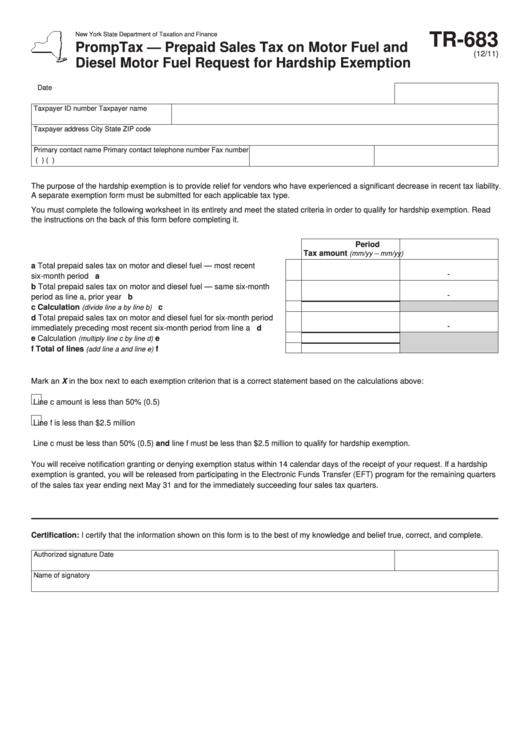

New York State Department of Taxation and Finance

TR-683

PrompTax — Prepaid Sales Tax on Motor Fuel and

(12/11)

Diesel Motor Fuel Request for Hardship Exemption

Date

Taxpayer ID number

Taxpayer name

Taxpayer address

City

State

ZIP code

Primary contact name

Primary contact telephone number

Fax number

(

)

(

)

The purpose of the hardship exemption is to provide relief for vendors who have experienced a significant decrease in recent tax liability.

A separate exemption form must be submitted for each applicable tax type.

You must complete the following worksheet in its entirety and meet the stated criteria in order to qualify for hardship exemption. Read

the instructions on the back of this form before completing it.

Period

Tax amount

(mm/yy – mm/yy)

a Total prepaid sales tax on motor and diesel fuel — most recent

-

six-month period ................................................................................

a

b Total prepaid sales tax on motor and diesel fuel — same six-month

-

period as line a, prior year .................................................................

b

c Calculation

..........................................................

c

(divide line a by line b)

d Total prepaid sales tax on motor and diesel fuel for six-month period

-

immediately preceding most recent six-month period from line a ......

d

e Calculation

.........................................................

e

(multiply line c by line d)

f Total of lines

.........................................................

f

(add line a and line e)

Mark an X in the box next to each exemption criterion that is a correct statement based on the calculations above:

Line c amount is less than 50% (0.5)

Line f is less than $2.5 million

Line c must be less than 50% (0.5) and line f must be less than $2.5 million to qualify for hardship exemption.

You will receive notification granting or denying exemption status within 14 calendar days of the receipt of your request. If a hardship

exemption is granted, you will be released from participating in the Electronic Funds Transfer (EFT) program for the remaining quarters

of the sales tax year ending next May 31 and for the immediately succeeding four sales tax quarters.

Certification: I certify that the information shown on this form is to the best of my knowledge and belief true, correct, and complete.

Authorized signature

Date

Name of signatory

1

1 2

2