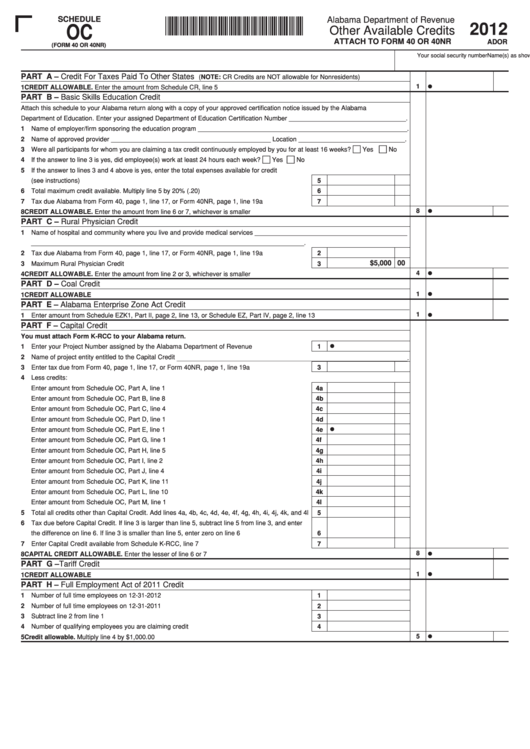

SCHEDULE

120008OC1283

Alabama Department of Revenue

2012

OC

Other Available Credits

ATTACH TO FORM 40 OR 40NR

ADOR

(FORM 40 OR 40NR)

Name(s) as shown on Form 40 or 40NR

Your social security number

PART A – Credit For Taxes Paid To Other States (NOTE: CR Credits are NOT allowable for Nonresidents)

•

1

1 CREDIT ALLOWABLE. Enter the amount from Schedule CR, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART B – Basic Skills Education Credit

Attach this schedule to your Alabama return along with a copy of your approved certification notice issued by the Alabama

Department of Education. Enter your assigned Department of Education Certification Number _________________________________.

1 Name of employer/firm sponsoring the education program ___________________________________________________________.

2 Name of approved provider _____________________________________________ Location ______________________________.

3 Were all participants for whom you are claiming a tax credit continuously employed by you for at least 16 weeks?

Yes

No

4 If the answer to line 3 is yes, did employee(s) work at least 24 hours each week?

Yes

No

5 If the answer to lines 3 and 4 above is yes, enter the total expenses available for credit

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Total maximum credit available. Multiply line 5 by 20% (.20). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Tax due Alabama from Form 40, page 1, line 17, or Form 40NR, page 1, line 19a . . . . . . . . . . . . .

7

•

8

8 CREDIT ALLOWABLE. Enter the amount from line 6 or 7, whichever is smaller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART C – Rural Physician Credit

1 Name of hospital and community where you live and provide medical services ___________________________________________

_____________________________________________________________________________.

2 Tax due Alabama from Form 40, page 1, line 17, or Form 40NR, page 1, line 19a . . . . . . . . . . . . .

2

$5,000 00

3 Maximum Rural Physician Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

•

4

4 CREDIT ALLOWABLE. Enter the amount from line 2 or 3, whichever is smaller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART D – Coal Credit

•

1

1 CREDIT ALLOWABLE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART E – Alabama Enterprise Zone Act Credit

•

1

1 Enter amount from Schedule EZK1, Part II, page 2, line 13, or Schedule EZ, Part IV, page 2, line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART F – Capital Credit

You must attach Form K-RCC to your Alabama return.

•

1 Enter your Project Number assigned by the Alabama Department of Revenue . . . . . . . . . . . . . . . .

1

2 Name of project entity entitled to the Capital Credit _________________________________________________________________.

3 Enter tax due from Form 40, page 1, line 17, or Form 40NR, page 1, line 19a . . . . . . . . . . . . . . . . .

3

4 Less credits:

a. CR Credit. Enter amount from Schedule OC, Part A, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

b. Basic Skills Education Credit. Enter amount from Schedule OC, Part B, line 8 . . . . . . . . . . . .

4b

c. Rural Physician Credit. Enter amount from Schedule OC, Part C, line 4 . . . . . . . . . . . . . . . . . .

4c

d. Coal Credit. Enter amount from Schedule OC, Part D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4d

•

e. Enterprise Zone Act Credit. Enter amount from Schedule OC, Part E, line 1 . . . . . . . . . . . . . .

4e

f. Tariff Credit. Enter amount from Schedule OC, Part G, line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . .

4f

g. Full Employment Act of 2011 Credit. Enter amount from Schedule OC, Part H, line 5 . . . . . .

4g

h. Heroes for Hire Tax Credit Act. Enter amount from Schedule OC, Part I, line 2 . . . . . . . . . . . .

4h

i. Heroes for Hire Tax Credit Act. Enter amount from Schedule OC, Part J, line 4. . . . . . . . . . . .

4i

j. Irrigation/Reservoir System Credit. Enter amount from Schedule OC, Part K, line 11 . . . . . .

4j

k. Credit for Taxes Paid to a Foreign Country. Enter amount from Schedule OC, Part L, line 10

4k

l. Alabama New Markets Development Credit. Enter amount from Schedule OC, Part M, line 1

4l

5 Total all credits other than Capital Credit. Add lines 4a, 4b, 4c, 4d, 4e, 4f, 4g, 4h, 4i, 4j, 4k, and 4l

5

6 Tax due before Capital Credit. If line 3 is larger than line 5, subtract line 5 from line 3, and enter

the difference on line 6. If line 3 is smaller than line 5, enter zero on line 6. . . . . . . . . . . . . . . . . . . .

6

7 Enter Capital Credit available from Schedule K-RCC, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

•

8

8 CAPITAL CREDIT ALLOWABLE. Enter the lesser of line 6 or 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART G – Tariff Credit

•

1

1 CREDIT ALLOWABLE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART H – Full Employment Act of 2011 Credit

1 Number of full time employees on 12-31-2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Number of full time employees on 12-31-2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Number of qualifying employees you are claiming credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

•

5

5 Credit allowable. Multiply line 4 by $1,000.00. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2