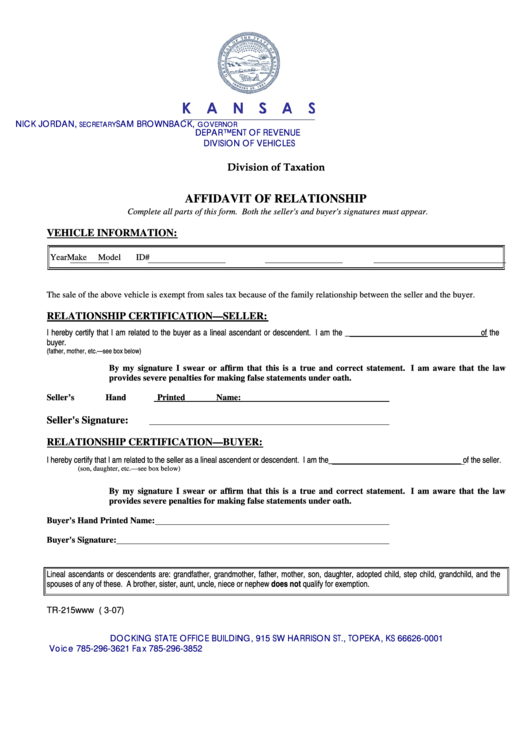

NICK JORDAN,

SAM BROWNBACK,

SECRETARY

GOVERNOR

DEPARTMENT OF REVENUE

DIVISION OF VEHICLES

Division of Taxation

AFFIDAVIT OF RELATIONSHIP

Complete all parts of this form. Both the seller's and buyer's signatures must appear.

VEHICLE INFORMATION:

Year

Make

Model

ID#

The sale of the above vehicle is exempt from sales tax because of the family relationship between the seller and the buyer.

RELATIONSHIP CERTIFICATION—SELLER:

I hereby certify that I am related to the buyer as a lineal ascendant or descendent. I am the ___________________________________of the

buyer.

(father, mother, etc.—see box below)

By my signature I swear or affirm that this is a true and correct statement. I am aware that the law

provides severe penalties for making false statements under oath.

Seller’s Hand Printed Name:

Seller's Signature:

RELATIONSHIP CERTIFICATION—BUYER:

____________________________

I hereby certify that I am related to the seller as a lineal ascendent or descendent. I am the

of the seller.

(son, daughter, etc.—see box below)

By my signature I swear or affirm that this is a true and correct statement. I am aware that the law

provides severe penalties for making false statements under oath.

Buyer's Hand Printed Name:

Buyer's Signature:

Lineal ascendants or descendents are: grandfather, grandmother, father, mother, son, daughter, adopted child, step child, grandchild, and the

spouses of any of these. A brother, sister, aunt, uncle, niece or nephew does not qualify for exemption.

TR-215www ( 3-07)

DOCKING STATE OFFICE BUILDING, 915 SW HARRISON ST., TOPEKA, KS 66626-0001

Voice 785-296-3621 Fax 785-296-3852

1

1