2 of 2

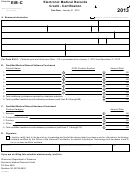

2013 Schedule EM

Page

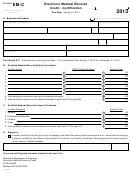

Instructions for 2013 Schedule EM

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

Line 1 Enter the amount of tax benefits reported on the

Purpose of Schedule EM

notice of eligibility received from the DOR .

Use Schedule EM to claim the electronic medical records

credit . The credit is available for taxable years beginning

Line 2

Enter the amount of electronic medical records

after December 31, 2011 and before January 1, 2014, to

credit passed through from tax-option (S) corporations,

taxpayers who are certified by the Wisconsin Department

partnerships, LLCs treated as partnerships, estates, or

of Revenue (DOR) .

trusts . The pass-through credit is shown on Schedule 5K-1

for shareholders of tax-option (S) corporations, Schedule

Who is Eligible to Claim the Credit

3K-1 for partners and LLC members, and Schedule 2K-1

for beneficiaries of estates or trusts.

Any individual, estate, trust, partnership, limited liability

company (LLC), corporation, tax-option (S) corporation,

Provide the following information about the pass through

insurance company, or tax-exempt organization that is

entity: the name of the entity, the federal employer identi-

certified by the DOR may be eligible for the credit.

fication number, and amount of credit passed through from

the other entities . If additional lines are required, attach a

The credit is based on the amount paid by the claimant

schedule .

in the taxable year for information technology hardware

or software that is used to maintain medical records in

Line 3a

Fiduciaries – Prorate the credit from line 3 be-

tween the entity and its beneficiaries in proportion to the

electronic form . The claimant must qualify as a health care

provider as defined in sec. 146.81(1)(a) to (p), Wis. Stats.

income allocable to each. Show the beneficiaries’ portion

of the credit on line 3a. Show the credit for each beneficiary

Partnerships, LLCs treated as partnerships, and tax-option

(S) corporations cannot claim the credit; instead the credit

on Schedule 2K-1 .

flows through to the partners, members, or shareholders

Line 3b Subtract line 3a from line 3. This is the estate’s

based on their ownership interests . Estates and trusts

share the credit with their beneficiaries in proportion to the

or trust’s portion of the credit. Fill in here and on the ap-

income allocable to each .

propriate line of Schedule CR .

No credit is allowed unless the claimant satisfies the fol-

Line 5

Enter the amount of credit from line 5 on the ap-

lowing requirements:

propriate line of Schedule CR . See the following exceptions:

• The claimant is certified by the DOR.

• If the claimant is a combined group member, enter the

• The claimant received from the DOR a notice of eligi-

amount of credit on Form 4M instead of Schedule CR .

bility to receive tax benefits that reports the amount of

tax benefit for which the claimant is eligible.

• Tax-option (S) corporations, partnerships, and LLCs

treated as partnerships should prorate the amount of

Credit is Income

credit on line 5 among the shareholders, partners, or

members based on their ownership interest . Show the

The credit that you compute on Schedule EM is income and

credit for each shareholder on Schedule 5K-1 and for

must be reported on your Wisconsin franchise or income

each partner or member on Schedule 3K-1 .

tax return in the year computed .

Required Attachment to Return

Carryforward of Unused Credits

File your completed Schedule EM with your Wisconsin

The electronic medical records credit is nonrefundable .

franchise or income tax return . Shareholders of tax-option

Any unused credit may be carried forward for 15 years .

(S) corporations, partners of partnerships, members of

LLCs treated as partnerships, and beneficiaries of estates

or trusts must file a copy of Schedule 5K-1, 3K-1, or 2K-1,

Credits computed but not used prior to the credits ex-

piring January 1, 2014 may be carried forward subject

as appropriate, with Schedule EM .

to the 15 year carry forward limitation.

Additional Information

If there is a reorganization of a corporation claiming the

electronic medical records credit, the limitations provided

For more information, you may contact any Department

by Internal Revenue Code section 383 may apply to the

of Revenue office or:

carryover of any unused credit .

• Call (608) 266-2772

• E-mail your question to: corp@revenue .wi .gov .

1

1 2

2