Form 42a801(D) (4-08) - Amended Employer'S Return Of Income Tax Withheld

ADVERTISEMENT

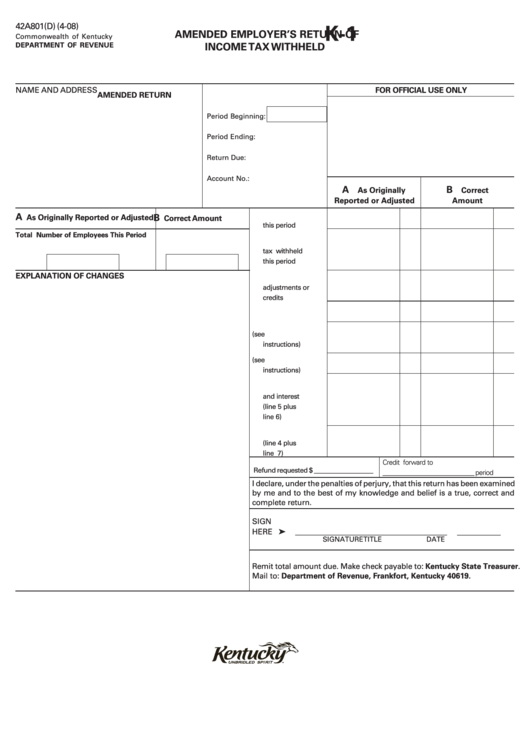

42A801(D) (4-08)

K-1

AMENDED EMPLOYER’S RETURN OF

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INCOME TAX WITHHELD

NAME AND ADDRESS

FOR OFFICIAL USE ONLY

AMENDED RETURN

Period Beginning:

Period Ending:

Return Due:

Account No.:

A

B

As Originally

Correct

Reported or Adjusted

Amount

1. Total wages paid

A

B

As Originally Reported or Adjusted

Correct Amount

this period ............

Total Number of Employees This Period

2. Kentucky income

tax withheld

this period ............

EXPLANATION OF CHANGES

3. Previous period

adjustments or

credits ...................

4. Net tax due ...........

5. Penalty (see

instructions) ..........

6. Interest (see

instructions) ..........

7 . Total penalty

and interest

(line 5 plus

line 6) ....................

8. Total amount due

(line 4 plus

line 7) ...................

Credit forward to

Refund requested $ __________________

____________________________ period

I declare, under the penalties of perjury, that this return has been examined

by me and to the best of my knowledge and belief is a true, correct and

complete return.

SIGN

HERE ➤

__________

_______________________

________________

SIGNATURE

TITLE

DATE

Remit total amount due. Make check payable to: Kentucky State Treasurer.

Mail to: Department of Revenue, Frankfort, Kentucky 40619.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1